–

Cygnus Metals Limited (ASX: CY5; TSXV: CYG) (‘Cygnus’ or the ‘Company’) refers to its announcement titled ‘Cygnus increases highly prospective, under-explored ground position by 50%’ released to ASX on 9 January 2025 (‘First Announcement’) and its announcement titled ‘Cygnus’ first drill hole returns up to 9.1% Cu outside Resource’ released to ASX on 23 January 2025 (‘Second Announcement’).

Clarifications regarding First Announcement

In discussions with the Company subsequent to the release of the First Announcement, the Australian Securities Exchange (‘ASX’) has requested the below:

- Clarification regarding the assumptions used in the copper metal equivalents calculations provided by Cygnus on the NI 43-101 compliant Foreign Mineral Resource Estimate for the Chibougamau Project in the First Announcement; and

- Further information regarding metallurgical test work completed to support the Company’s metallurgical recovery assumptions provided in this clarification announcement.

The Company wishes to provide further information on these assumptions and the metallurgical test work previously completed by Doré Copper Mining Corp (‘Doré’), but emphasises that the clarification does not affect the Foreign Mineral Resource Estimate or the Copper Equivalent (‘CuEq’) figures as set out in Appendix A of the First Announcement and as first disclosed by the Company on 15 October 2024.

Note 6 of Appendix A on page 6 of the First Announcement is replaced with the following (‘First Clarification’):

‘Metal equivalents for the foreign estimate have been calculated at a copper price of US$8,750/t, gold price of US$2,350/oz. Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.77258). Metallurgical recovery factors have been applied to the copper equivalents calculation, with copper metallurgical recovery assumed at 95% and gold metallurgical recovery assumed at 85% based upon historical production at the Chibougamau Processing Facility and more recent metallurgical test work. It is the Company’s view that all elements in the copper equivalent calculations have a reasonable potential to be recovered and sold.’

The Company confirms that the Foreign Mineral Resource Estimate and metal equivalents calculation do not contain any other metals, including silver. In fact, the inclusion of silver represents a further opportunity for the Company and will be reviewed in future work.

Other than the First Clarification above, there are no changes to the First Announcement.

In support of the First Clarification, attached to this announcement are the results of metallurgical test work previously completed by Doré.

Clarifications regarding Second Announcement

In discussions with the Company subsequent to the release of the Second Announcement, the ASX has requested that the Company provide further information regarding two of the three electromagnetic (‘EM’) plates referred to in Figures 1 and 2 of the Second Announcement in accordance with ASX Listing Rules 5.6 and 5.7.

The Company wishes to note that the two additional untested EM plates to the south of the new EM plate referred to in the Second Announcement were identified from geophysics programs conducted by previous owners of the Chibougamau Project and provides the additional information set out in the Appendix to this clarification announcement (‘Second Clarification’).

A fixed loop EM (‘FLEM’) survey was conducted in 2007 by Crone Geophysics for Novawest Resources. Results from this survey, which Southern Geoscience Consultants (‘SGC’) has reprocessed for Cygnus, highlighted a conductor to the south of the Corner Bay deposit. A downhole EM (‘DHEM’) survey was conducted by Doré in 2021 on drillhole CB-21-93. The survey, which SGC has reprocessed for Cygnus, highlighted a further conductor to the south of the Corner Bay deposit.

Other than the Second Clarification, there are no changes to the Second Announcement.

This announcement has been authorised for release by the Board of Directors of Cygnus.

David Southam

Managing Director

T: +61 8 6118 1627

E: info@cygnusmetals.com |

Ernest Mast

President & Managing Director

T: +1 647 921 0501

E: info@cygnusmetals.com |

Media:

Paul Armstrong

Read Corporate

+61 8 9388 1474 |

About Cygnus Metals

Cygnus Metals Limited (ASX: CY5, TSXV: CYG) is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

Qualified Persons and Compliance Statements

The scientific and technical information relating to metal equivalents in this news release has been reviewed and approved by Ms Laurence Huss, the Quebec In-Country Manager of Cygnus, a ‘qualified person’ as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Company first announced the foreign estimate of mineralisation for the Chibougamau Project on 15 October 2024. The Company confirms that the supporting information included in the announcement of 15 October 2024 continues to apply other than in respect of the Clarification, and (notwithstanding the Clarification) has not materially changed.

Cygnus confirms that (notwithstanding the Clarification) it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the estimates in the original announcement continue to apply and have not materially changed. Cygnus confirms that it is not in possession of any new information or data that materially impacts on the reliability of the estimates or Cygnus’ ability to verify the foreign estimates as mineral resources in accordance with the JORC Code. The Company confirms that the form and context in which the Competent Persons’ findings are presented have not been materially modified from the original market announcement.

The scientific and technical information relating to exploration results in this news release has been reviewed and approved by Mr Louis Beaupre, the Quebec Exploration Manager of Cygnus, a ‘qualified person’ as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Exploration Results disclosed in this announcement are based on and fairly represent information and supporting documentation compiled by Mr Beaupre. Mr Beaupre holds options in Cygnus. Mr Beaupre is a member of the Ordre des ingenieurs du Quebec (P Eng), a Registered Overseas Professional Organisation as defined in the ASX Listing Rules, and has sufficient experience which is relevant to the style of mineralisation and type of deposits under consideration and to the activity which has been undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Beaupre consents to the inclusion in this release of the matters based on the information in the form and context in which they appear.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Appendix – Second Clarification

Section 1 (Sampling Techniques and Data) and Section 2 (Reporting of Exploration Results) of Appendix C (2012 JORC Table 1) of the Second Announcement are deleted and replaced as follows:

Section 1 Sampling Techniques and Data

| Criteria |

JORC Code explanation |

Commentary |

| Sampling techniques

|

Nature and quality of sampling (eg cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc). These examples should not be taken as limiting the broad meaning of sampling. |

- All current drilling conducted at the Chibougamau Project was completed under the supervision of a registered professional geologist as a Qualified Person (QP) who is responsible and accountable for the planning, execution, and supervision of all exploration activity as well as the implementation of quality assurance programs and reporting.

- All drilling reported is NQ2 (47.8 mm diameter)

- DHEM surveys have been completed on surface drillholes

- Historic FLEM surveys were acquired from surface

- Historic FLEM stations were planned along survey lines perpendicular to geological strike

|

| Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. |

- NQ core was marked for splitting during logging and is sawn using a diamond core saw with a mounted jig to assure the core is cut lengthwise into equal halves.

- Half of the cut core is placed in clean individual plastic bags with the appropriate sample tag.

- The remaining half of the core is retained and incorporated into Cygnus’s secure, core library located on the property

- No samples were taken for the electromagnetic survey work.

|

| Aspects of the determination of mineralisation that are Material to the Public Report.

In cases where ‘industry standard’ work has been done this would be relatively simple (eg ‘reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay’). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information.

|

- Industry standard sampling practices were used with sample lengths ranging from 0.3 m to 1.0 m and respected geological contacts. Sample tags were placed at the beginning of each sample interval and the tag numbers were recorded in an MS Excel database.

- Sampling practice is considered to be appropriate to the geology and style of mineralisation

|

| Drilling techniques |

Drill type (eg core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (eg core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc). |

- Diamond core was drilled using surface diamond rigs with industry recognised contractors Miikan Drilling. Miikan is a joint venture between Chibougamau Diamond Drilling Ltd., the First Nations community of Ouje-Bougoumou and the First Nations community of Mistissini both located in the Eeyou Istchee territory.

- Drilling was conducted using NQ core size

- Directional surveys have been taken at 50m intervals

|

| Drill sample recovery |

Method of recording and assessing core and chip sample recoveries and results assessed.

Measures taken to maximise sample recovery and ensure representative nature of the samples.

Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material.

|

- Diamond core recovery was measured for each run and calculated as a percentage of the drilled interval.

- Overall, the core recoveries are excellent in the Chibougamau area

- No drilling was undertaken for the electromagnetic survey work.

|

| Logging

|

Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. |

- All core was geologically and geotechnically logged. Lithology, veining, alteration and mineralisation are recorded in multiple tables of the drillhole database

- No logging was undertaken for the electromagnetic survey work.

|

| Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. |

- Geological logging of core is qualitative and descriptive in nature.

|

| The total length and percentage of the relevant intersections logged. |

- 100% of the core has been logged

|

| Sub-sampling techniques and sample preparation |

If core, whether cut or sawn and whether quarter, half or all core taken.

If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry.

For all sample types, the nature, quality and appropriateness of the sample preparation technique.

Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples.

Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling.

Whether sample sizes are appropriate to the grain size of the material being sampled.

|

- The NQ2 diameter the core was sawn in half following a sample cutting line determined by geologists during logging and submitted for analysis on nominal 1m intervals or defined by geological boundaries determined by the logging geologist

- Each core sample is assigned a tag with a unique identifying number. Sample lengths are typically one metre but can be depending on zone mineralogy and boundaries.

- This sampling technique is industry standard and deemed appropriate.

- No subsampling was undertaken for the electromagnetic survey work.

|

| Quality of assay data and laboratory tests

|

The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. |

- Sample (NQ size half core) preparation and fire assay analysis were done at Bureau Veritas Commodities Canada Ltd (‘BV’) in Timmins, Ontario, and ICP-ES multi-elements analysis was done at BV in Vancouver, B.C.

- Samples were weighed, dried, crushed to 70% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 µm.

- Samples are fire assayed for gold (Au) (30 g) and multi-acid digestion ICP-ES finish, for 23 elements (including key elements Ag, Cu, Mo).

- Samples assaying >10.0 g/t Au are re-analysed with a gravimetric finish using a 30 g charge. Samples assaying >10% Cu are re-analysed with a sodium peroxide fusion with ICP-ES analysis using a 0.25 g charge.

|

| For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. |

- CY5 commissioned Southern Geoscience Consultants (SGC) of Perth to supervise and plan the recent DHEM surveys that were acquired by Géophysique TMC

- SGC were also commissioned to reinterpret some DHEM collected by Géophysique TMC from 2021

- Survey Details for DHEM

- Survey Configuration: Downhole TEM (DHTEM)

- TX Loop Size: 620 x 450m

- Transmitter: Crone Geophysics Pulse Transmitter

- Receiver: Crone Geophysics Pulse Receiver

- Sensor: Crone Geophysics 3 component dB/dt induction coil

- Component Directions: Axial (A), and cross-hole (U and V)

- Station Spacing: 10m with 5m infill

- TX Frequency: 5 Hz

- Duty cycle: 50%

- Current: 20 Amps

- Powerline Frequency: 60 Hz

- Base frequency: 50 msec

- Stacks: 256 stacks per reading

- CY5 also commissioned SGC to reprocess the historic FLEM that was conducted in 2007 under the supervision of Crone Geophysics and Exploration Ltd

- The equipment used on this project was a Crone Pulse EM Surface system. This includes a 4.8kW transmitter with a 240V voltage regulator powered by an 11 hp motor generator. The Crone Digital Receiver was used to collect the field data. The synchronization between the Transmitter and the Receiver was maintained by crystal clock synchronization for surface work

- TX Loop Size: 900 x 800m

- Ramp Time: 1.5ms

- Current: 15 amps

- Time Base: 16.66 msec

|

| Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

- Laboratory QC procedures involve the use of internal certified reference material as assay standards, along with blanks, duplicates and replicates

- Geophysical data was recorded on a Crone Geophysics Pulse Receiver then emailed to SGC for analysis and verification

|

| Verification of sampling and assaying

|

The verification of significant intersections by either independent or alternative company personnel. |

- No sampling was undertaken for the electromagnetic survey work.

|

| The use of twinned holes. |

|

| Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. |

- All logging data was completed, core marked up, logging and sampling data was entered directly into the database.

- The logged data is stored on the site server directly.

|

| Discuss any adjustment to assay data. |

- There was no adjustment to the assay data

|

| Location of data points

|

Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. |

- The location of the drillholes and the aiming points for the orientation of the drillholes were indicated on the ground using identified stakes. The stakes marking the location of the drillholes were set up and located with a Garmin GPS model ‘GPSmap 62s’ (4m accuracy)

- Surveys are collected using a Reflex EZ-Shot® single-shot electronic instrument with readings collected at intervals of approximately every 30 m downhole plus a reading at the bottom of the hole

- Surface geophysical measurement locations were determined using a hand-held GPS. The accuracy of this unit at most sample sites was +/- 3m to 5m

- The DHEM station positions are estimated using a winch counter that measures to the nearest cm accuracy with gyro survey files to accurately locate the survey stations in space.

- FLEM stations were planned perpendicular to geological strike, and all were surveyed with hand-held GPS

|

| Specification of the grid system used. |

- The grid system used is UTM NAD83 (Zone 18)

|

| Quality and adequacy of topographic control. |

- A Digital Terrane Model (DTM) has been used to accurately plot the vertical position of the holes

|

| Data spacing and distribution

|

Data spacing for reporting of Exploration Results. |

- The drill spacing is considered appropriate for this type of exploration

- DHEM is 10m stations with 5m and 1m infill and FLEM data is 100m station spacing

- The station spacings are considered to be sufficient for sampling the anomalous response for detailed quantitative modelling

|

| Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied.

|

- No resource estimation is made

|

| Whether sample compositing has been applied. |

- No sample compositing has been applied

|

| Orientation of data in relation to geological structure

|

Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. |

- Drilling is orientated approximately at right angles to the currently interpreted strike of the known interpreted mineralisation. Reported intersections appear close to true width

- FLEM stations were planned perpendicular to geological strike

- DHEM surveys records 3D data and target orientation relative to the survey orientation is not deemed to be important in the modelling

|

| If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material.

|

- No bias is considered to have been introduced by the existing sampling orientation

|

| Sample security |

The measures taken to ensure sample security. |

- Core was placed in wooden core boxes close to the drill rig by the drilling contractor. The core was collected daily by the drilling contractor and delivered to the secure core logging facility. Access to the core logging facility is limited to Cygnus employees or designates

|

| Audits or reviews |

The results of any audits or reviews of sampling techniques and data. |

- No audits have been undertaken, therefore information on audits or reviews is not yet available

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria |

JORC Code Explanation |

Commentary |

| Mineral tenement and land tenure status

|

Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. |

- The data reported within this announcement is from the Chibougamau Project. The Chibougamau project consists of 3 properties which includes:

- Copper Rand (1 mining license, 19 mining concession and 147 exploration claims)

- Corner Bay – Devlin (1 mining license, 111 exploration claims)

- Joe Mann (2 mining concessions, 74 exploration claims)

- Copper Rand and Corner Bay – Devlin are held 100% by CBAY minerals Inc, a wholly owned subsidiary of Dore Copper.

- 767ha of the Joe Mann property is held by CBAY with the remaining 1965ha held under option agreement with Resources Jessie.

- The properties collectively making up the Project are in good standing based on the Ministry of Energy and Natural Resources (Ministère de l’Énergie et des Ressources Naturelles) GESTIM claim management system of the Government of Québec.

|

| The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. |

- All tenure is in good standing

|

| Exploration done by other parties |

Acknowledgment and appraisal of exploration by other parties. |

- The Chibougamau Copper and Gold project comprising Corner Bay, Devlin, Cedar Bay and Joe Mann have seen an extensive exploration history dating back to the early 1900s. The PEA (as referred to in the Company’s announcement of 15 October 2024) provides a detailed history of the exploration activities undertaken by previous explorers.

- Corner Bay was first identified as a prospect in 1956

- 1956 – 1972 eight drilling programs totalling 1,463 m and various geophysical and electromagnetic (EM) surveys

- 1973 – 1981 Riocanex and Flanagan McAdam: ground geophysical surveys and 43 diamond drill holes

- 1982 – 1984 Riocanex and Corner Bay Exploration: 38 drill holes and metallurgical test work

- 1988 – 1991 Corner Bay Exploration: diamond drilling, geophysical surveys and geological characterisation with initial MRE

- 1992 – 1994 SOQUEM optioned and acquired a 30% interest, and completed diamond drilling

- 1994 Explorations Cache Inc and Ressources MSV Inc: diamond drilling

- 2004 – 2006 GéoNova and MSV: 98 diamond drill holes and first Technical Report on the Corner Bay project reporting a MRE

- 2007 – 2009 Campbell: diamond drilling and bulk sample

- 2012 – 2019 CBAY / AmAuCu: diamond drilling and MRE

- Devlin identified in 1972 by airborne survey flown by the MERN

- 1979 – 1981 diamond drilling, geophysical surveys

- 1981 development commenced

- Joe Mann identified in 1950 with the commencement of mining activities occurring in 1956

- The Joe Mann mine operated underground during three different periods from 1956 to 2007

- In July 2012, Ressources Jessie acquired the Joe Mann mine property, but conducted only surface exploration work

- Cedar Bay was discovered prior to 1927 by Chibougamau McKenzie Mines Ltd

- From initial discovery to 2013 various surface and underground drilling campaigns and geophysical surveys undertaken by various companies

|

| Geology |

Deposit type, geological setting and style of mineralisation. |

- Corner Bay and Devlin are located at the northeastern extremity of the Abitibi subprovince in the Superior province of the Canadian Shield and are examples of Chibougamau-type copper-gold deposits. The Abitibi subprovince is considered as one of the largest and best-preserved greenstone belts in the world and hosts numerous gold and base metal deposits.

- The Corner Bay deposit is located on the southern flank of the Doré Lake Complex (DLC). It is hosted by a N 15° trending shear zone more or less continuous with a strong 75° to 85° dip towards the west. The host anorthosite rock is sheared and sericitized over widths of 2 m to 25 m. The deposit is cut by a diabase dyke and is limited to the north by a fault structure and to the south by the LaChib deformation zone.

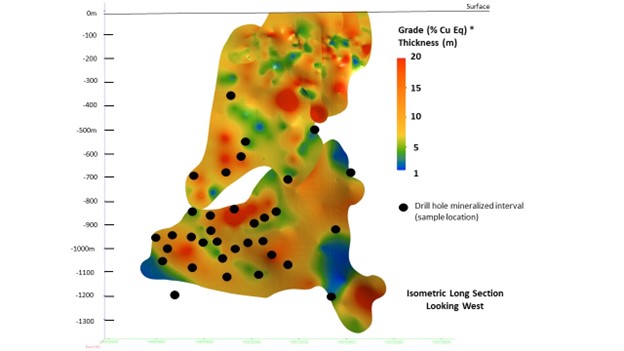

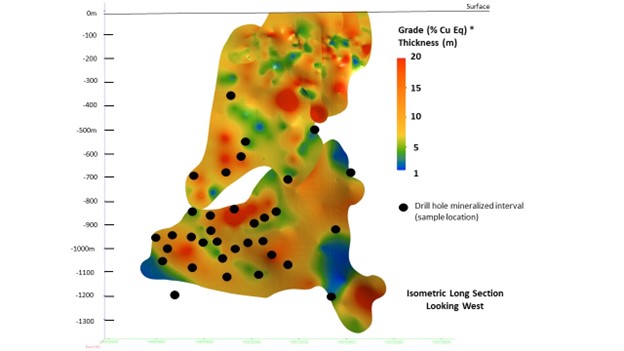

- The Corner Bay deposit consists of three main mineralized lodes (subparallel Main Lode 1 and Main Lode 2 above the dyke, and Main Lode below the dyke that make up the bulk of the deposit. The Corner Bay deposit has been traced over a strike length to over 1,100 m to a depth of 1,350 m and remains open at depth.

- The mineralization is characterized by veins and/or lenses of massive to semi-massive sulphides associated with a brecciated to locally massive quartz-calcite material. The sulphide assemblage is composed of chalcopyrite, pyrite, and pyrrhotite with lesser amounts of molybdenite and sphalerite. Late remobilized quartz-chalcopyrite-pyrite veins occur in a wide halo around the main mineralization zones.

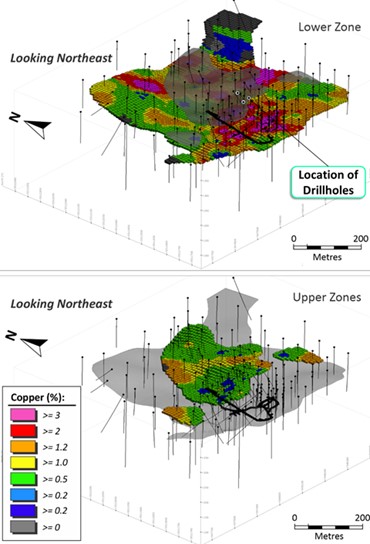

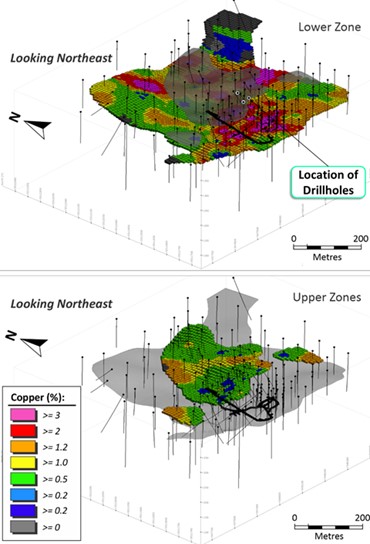

- Devlin is a flat-lying, copper-rich lodes-hosted deposit in a polygenic igneous breccia that is less than 100 m from the surface. The tabular bodies have been modelled as four nearly horizontal lodes: a more continuous lower zone and three smaller lodes comprising the upper zone. Mineralization is reflected as a fracture zone often composed of two or more sulphide-quartz lodes and stringers. Thickness of the mineralized zones range from 0.5 m to 4.4 m. It has been diluted during modelling to reflect a minimum mining height of 1.8 m.

- The Joe Mann deposit is characterized by east-west striking shear hosted lodes that extend beyond 1,000 m vertically with mineralization identified over a 3 km strike length. These shear zones form part of the Opawica-Guercheville deformation zone, a major deformation corridor cutting the mafic volcanic rocks of the Obatogamau Formation in the north part of the Caopatina Segment. The gabbro sill hosts the Main Zone and the West Zone at the mine, while the South Zone is found in the rhyolite. These three subvertical E-W (N275°/85°) ductile-brittle shear zones are sub-parallel to stratigraphy and to one another, with up to 140 m to 170 m of separation between them. These shear zones are hosted within a stratigraphic package composed of iron-magnesium (Fe-Mg) carbonate and sericite altered gabbro sills, sheared basalts, and intermediate to felsic tuffs intruded by various felsic intrusions. The Joe Mann gold mineralization is hosted by decimetre scale quartz-carbonate lodes (Dion and Guha 1988). The lodes are mineralized with pyrite, pyrrhotite, and chalcopyrite disposed in lens and lodelets parallel to schistosity, and occasionally visible gold. There are some other minor, mineralized structures, e.g., North and South-South Zones, with limited vertical and horizontal extensions.

|

| Drill hole Information |

A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes:

- easting and northing of the drill hole collar

- elevation or RL (Reduced Level – elevation above sea level in metres) of the drill hole collar

- dip and azimuth of the hole

- down hole length and interception depth

- hole length.

If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case.

|

- All requisite drillhole information is tabulated elsewhere in this release. Refer Appendix A of the body text.

- The location of the DHEM and FLEM is set out in ‘Diagram’ below.

|

| Data aggregation methods

|

In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (eg cutting of high grades) and cut-off grades are usually Material and should be stated. |

- All drill hole intersections are reported above a lower cut-off grade of 0.5% copper.

|

| Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. |

- A maximum of 1m internal waste was allowed

|

| The assumptions used for any reporting of metal equivalent values should be clearly stated. |

- No metal equivalents reported

|

| Relationship between mineralisation widths and intercept lengths |

These relationships are particularly important in the reporting of Exploration Results.

If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported.

If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg ‘down hole length, true width not known’).

|

- All intersections reported in the body of this release are down hole.

- The majority of the drill holes in the database are drilled as close to orthogonal to the plane of the mineralized lodes as possible.

- Only down hole lengths are reported.

|

| Diagrams |

Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. |

- For Drill Results included elsewhere in this release refer figures in the body text

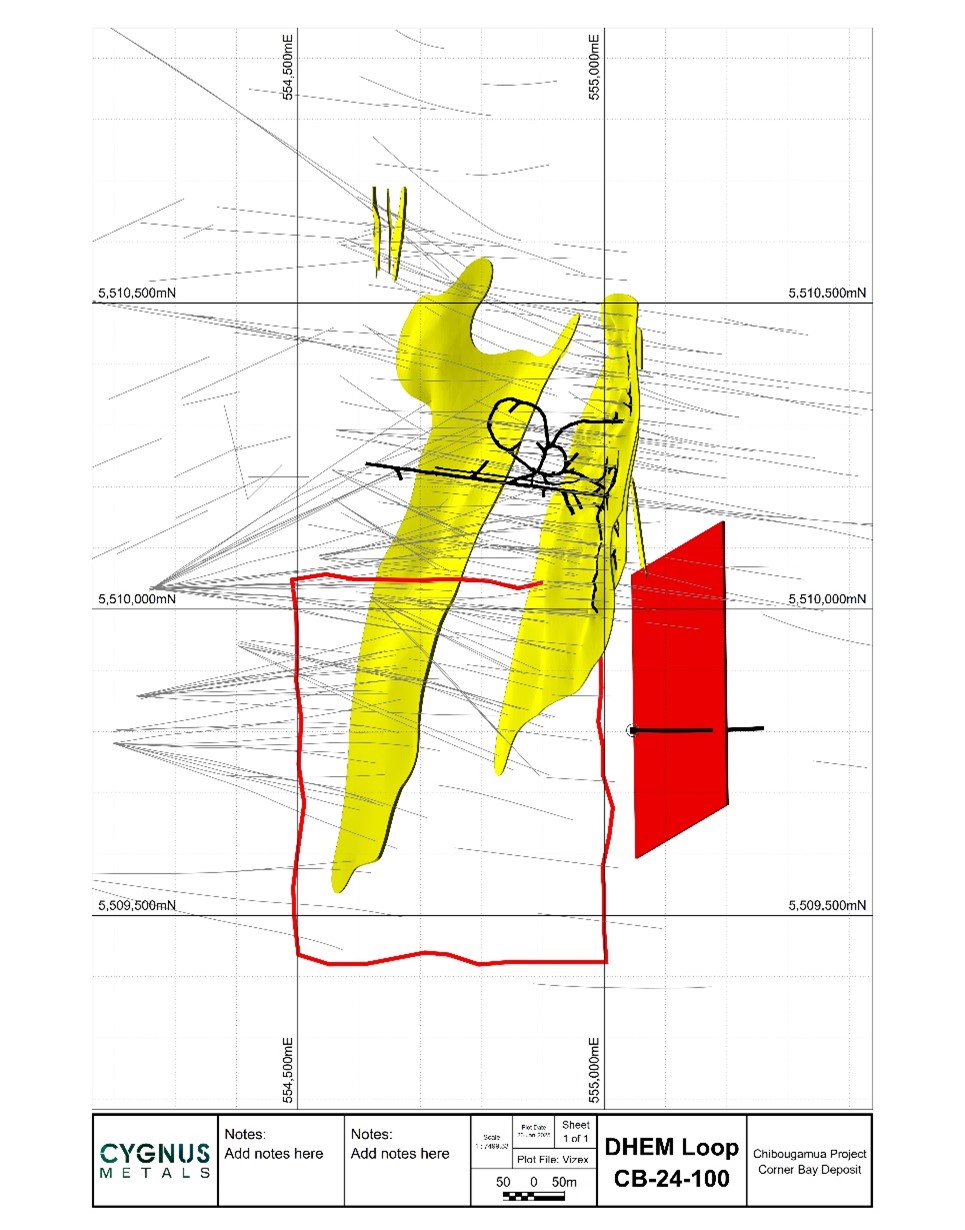

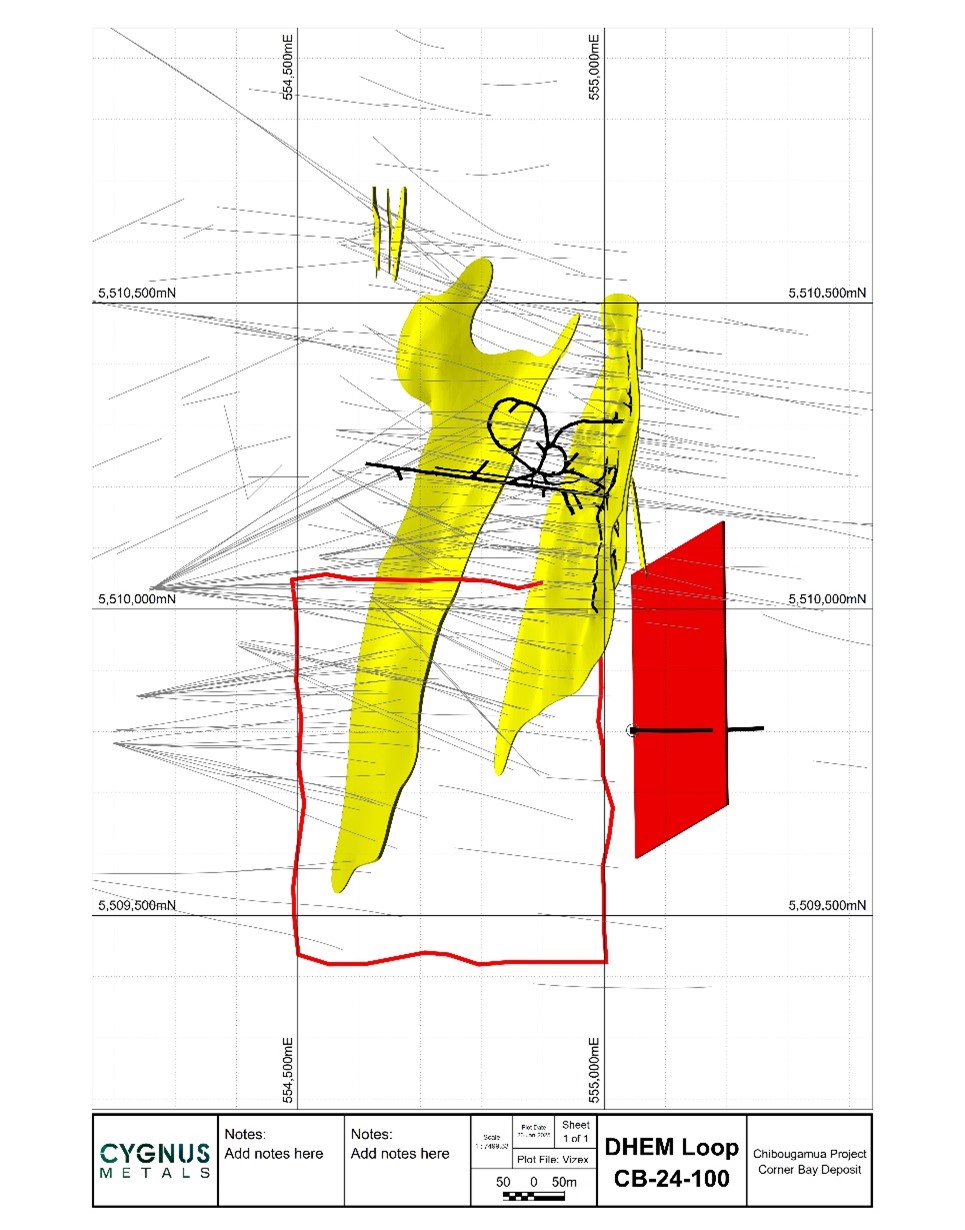

- Image 1 below shows DHEM loop on CB-24-100

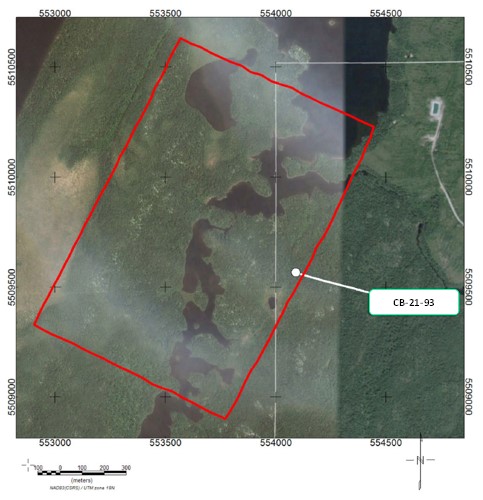

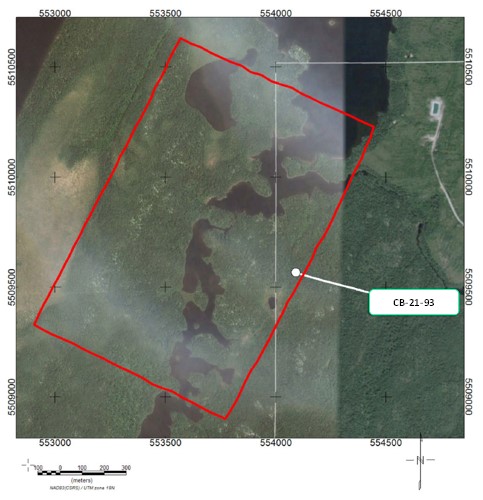

- Image 2 below shows DHEM loop on CB-21-93 (red outline illustrates the EM loop and white line the location of drillhole CB-21-93)

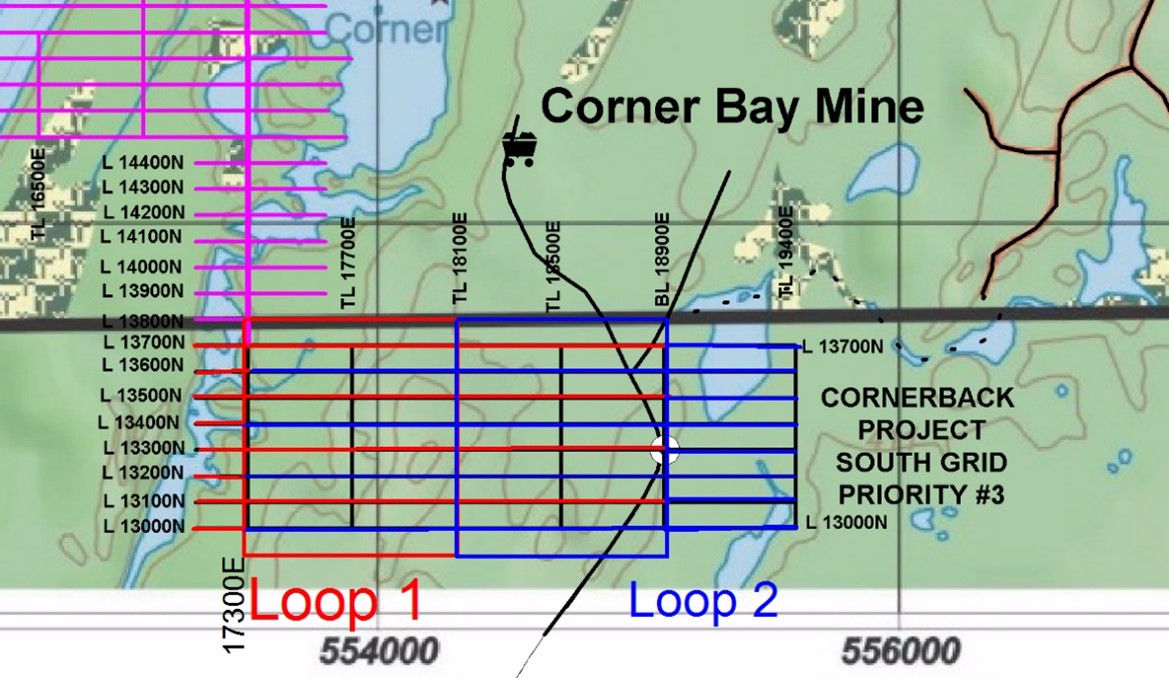

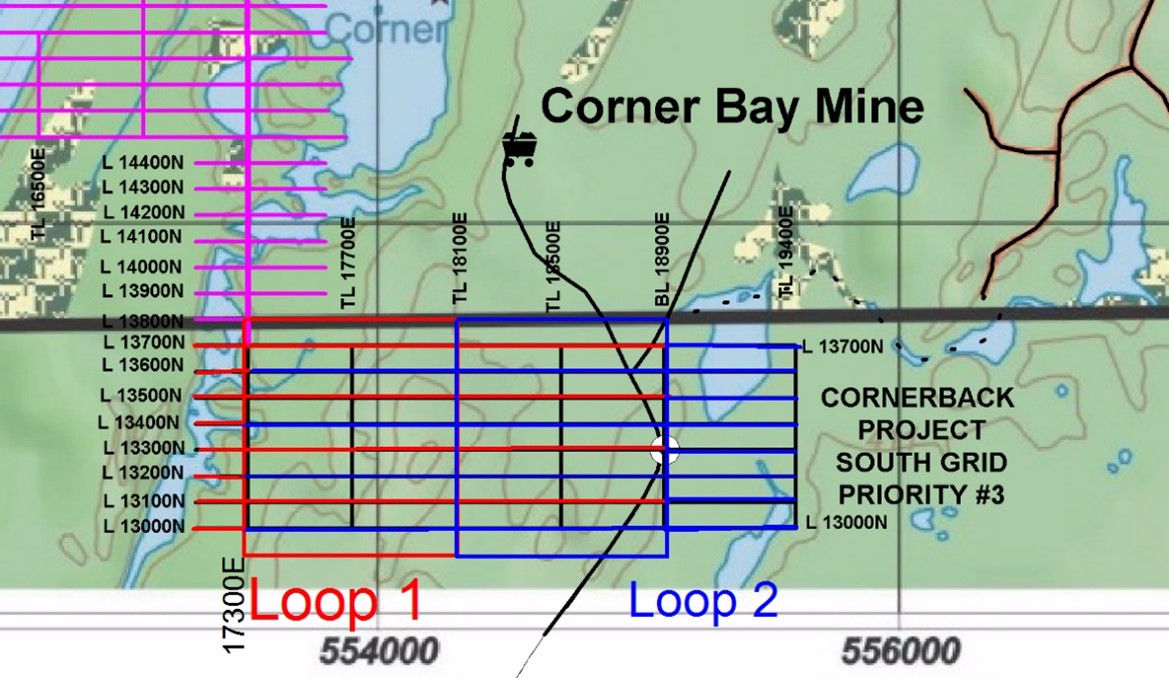

- Image 3 below illustrating loop and planned survey lines from 2007 FLEM (blues lines illustrate the planned survey lines for the anomaly outlined in the announcement)

|

| Balanced reporting |

Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. |

- All results greater than 0.5% Cu and 0.5g/t Au have been reported at greater than 1m width

|

| Other substantive exploration data |

Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples – size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. |

- Appropriate plans are included in the body of this release.

|

| Further work |

The nature and scale of planned further work (eg tests for lateral extensions or depth extensions or large-scale step-out drilling).

Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive.

|

- The Company will be conducting drill testing of additional mineralisation as well as step out drilling of existing lodes to further enhance the resources quoted in this release. More information is presented in the body of this report.

- Diagrams in the main body of this release show areas of possible resource extension on existing lodes. The company continues to identify and assess multiple other target areas within the property boundary for additional resources.

|

Image 1 below shows DHEM loop on CB-24-100

Image 2 below shows DHEM loop on CB-21-93 (red outline illustrates the EM loop and white line the location of drillhole CB-21-93)

Image 3 below illustrating loop and planned survey lines from 2007 FLEM (blues lines illustrate the planned survey lines for the anomaly outlined in the announcement)

Chibougamau Copper-Gold Project, Canada

Flotation copper recoveries of

up to 98.2% at Corner Bay

Metallurgical test work conducted at the Chibougamau Project indicates a high-quality clean concentrate with low impurities from the Corner Bay flagship asset

HIGHLIGHTS:

- Metallurgical test work at Corner Bay demonstrates:

- Copper recoveries of 98.2% and 96.8% from a sample from an ore sorting test

- High-quality copper concentrate grades results of 27.0% and 29.6%

- Clean concentrate with minimal deleterious elements

- Corner Bay is the flagship asset at the Chibougamau Project with an Indicated Mineral Resources of 2.7Mt at 2.9% CuEq and Inferred Mineral Resources of 5.9Mt at 3.6% CuEq 1

- Metallurgical test work is being conducted as part of the ongoing study work at the Chibougamau Project

- Test work includes locked cycle flotation tests that approximate a future flowsheet

- The Chibougamau Project has excellent infrastructure with a 900,000tpa processing facility, local mining town, sealed highway, airport, regional rail infrastructure and 25kV hydro power to the processing site.

________________

1 The Mineral Resource Estimate at the Chibougamau Project is a foreign estimate prepared in accordance with CIM Standards. A competent person has not done sufficient work to classify the foreign estimate as a mineral resource in accordance with the JORC Code, and it is uncertain whether further evaluation and exploration will result in an estimate reportable under the JORC Code.

| Cygnus Executive Chairman, David Southam said: ‘The results demonstrate the viability of the project as we continue along our dual track exploration and development pathway with high recoveries and a clean high grade concentrate’. |

Cygnus Metals Limited (ASX: CY5; TSXV: CYG) (‘Cygnus’ or the ‘Company’) is pleased to announce positive flotation test results at its flagship Corner Bay deposit within the Chibougamau Copper-Gold Project in Quebec, Canada.

The results have been released in connection with a response to a query from ASX concerning the basis on which Cygnus announced metal equivalent grades in an announcement dated 9 January 2025, which referred to its NI 43-101 compliant Foreign Mineral Resource Estimate for the Chibougamau Project (‘Announcement’). The results of the metallurgical test program contained in this announcement have been considered by the Company in informing the metallurgical recovery rates contained in the Announcement and subsequent clarification announcement dated 28 January 2025. When Cygnus first disclosed the acquisition of Doré Copper Mining Corp on 15 October 2024, it did not consider that the metallurgical test-work was a material exploration result. Following queries from ASX, the Company has considered that the metallurgical test work contained in this announcement is information that is necessary to support the assumptions made about metal recoveries in Cygnus’ copper equivalent statement in the Announcement.

This metallurgical test program conducted by Doré Copper Mining Corp. in 2023 was part of work designed to support ongoing study work at the Chibougamau Project.

The results demonstrate copper recoveries of 98.2% and 96.8% from a representative composite sample and high-quality copper concentrate grades results of 27.0% and 29.6%.

These results were previously released by Doré Copper Mining Corporation on October 30, 2023.

Latest Metallurgical Test Work Program Summary

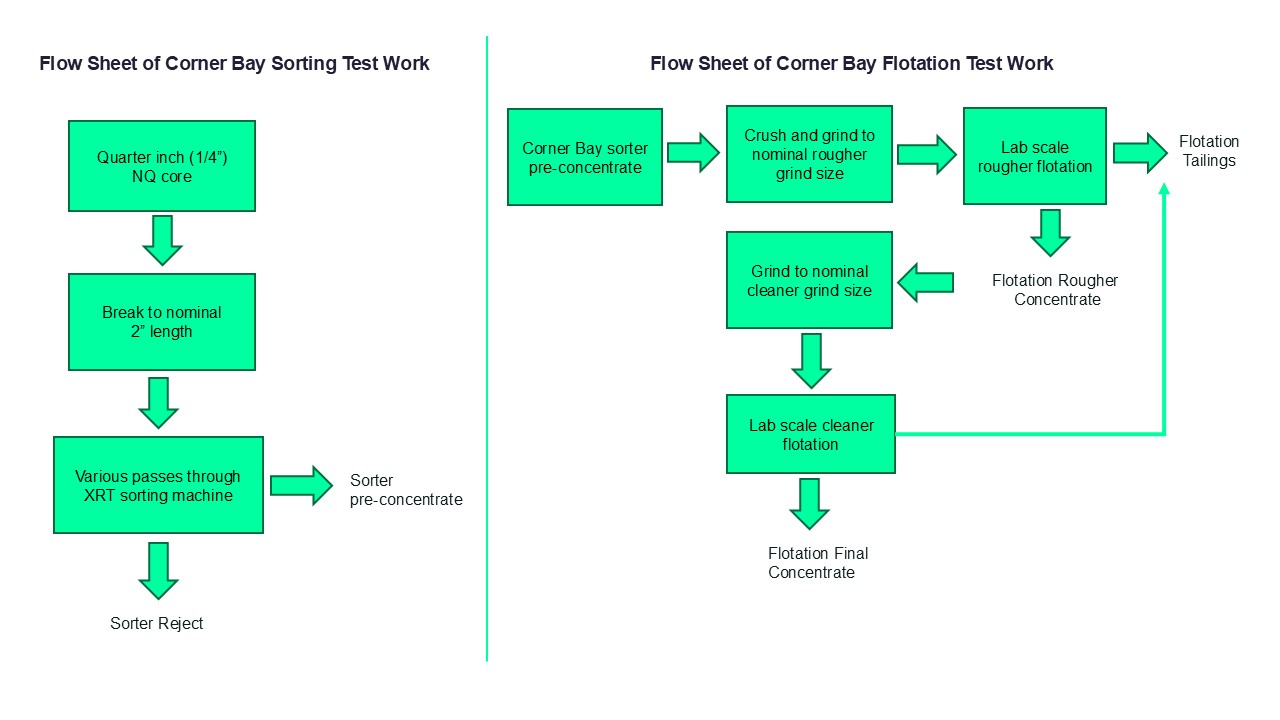

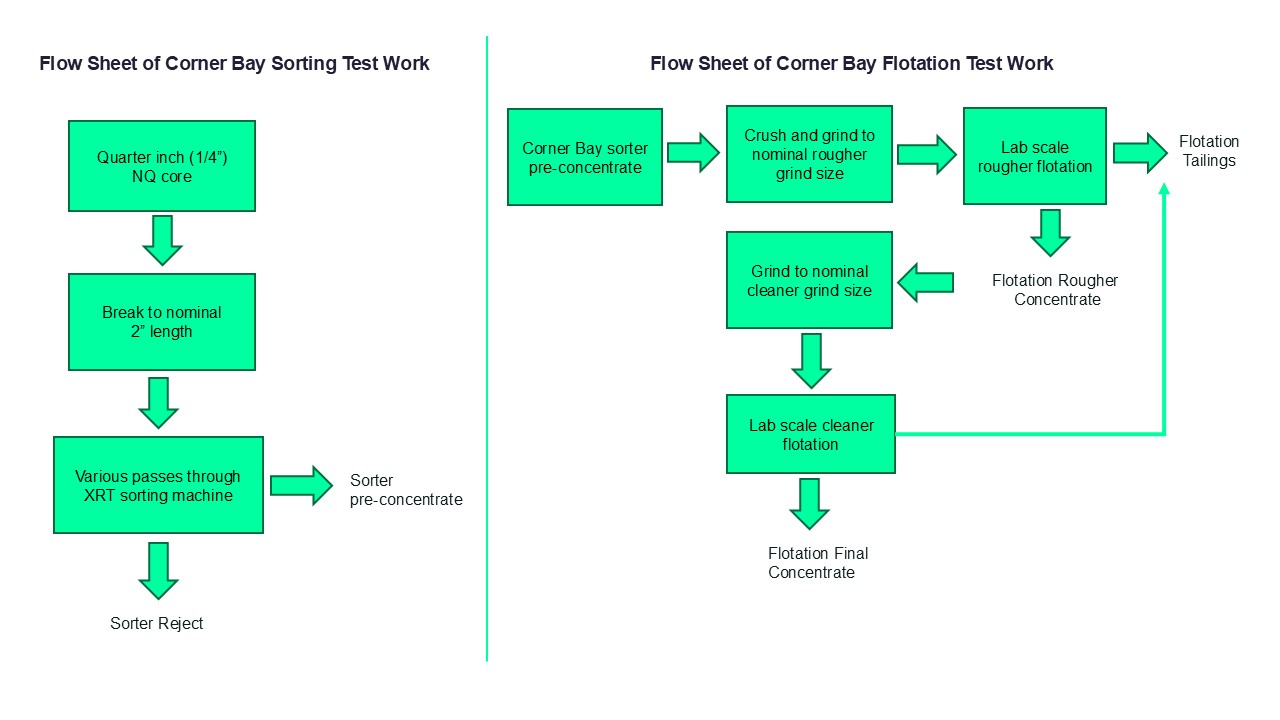

Base Metallurgical Laboratories in Kamloops, British Columbia was commissioned to complete Corner Bay metallurgical development and locked cycle flotation testing in support of ongoing study work.

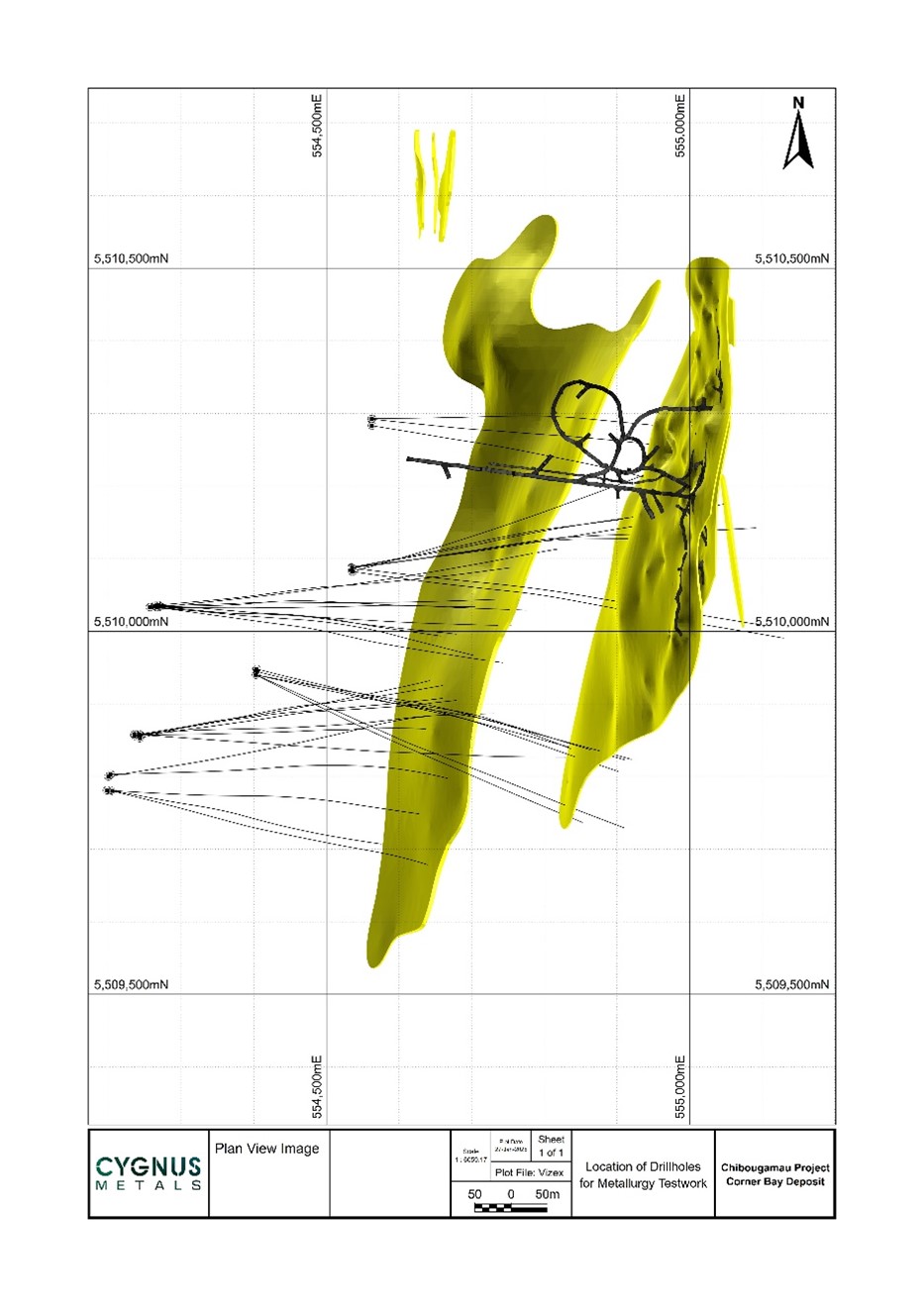

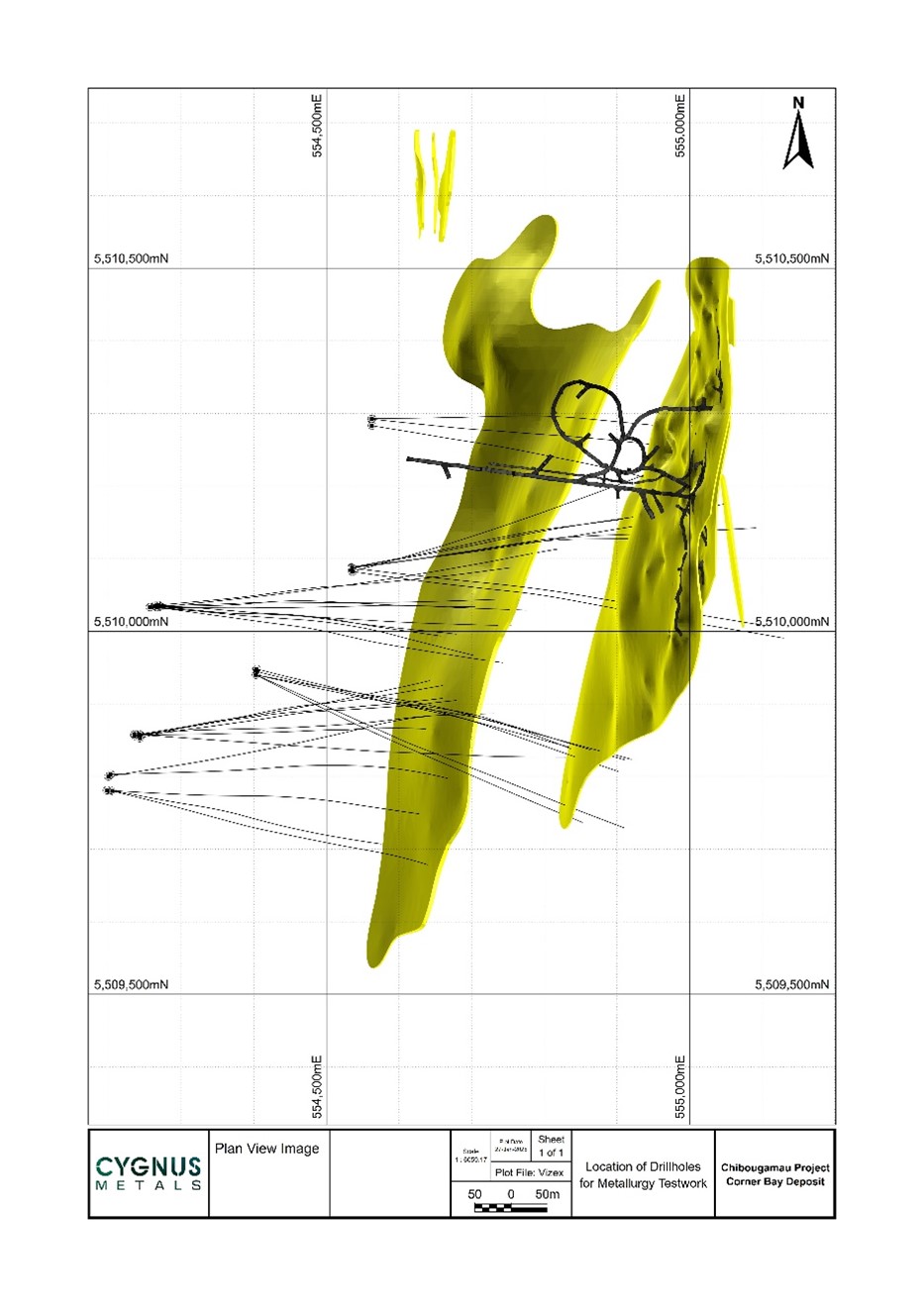

A total of 34 diamond drill core were used to create a spatially diverse composite sample that intersected copper mineralized zones within the Corner Bay Foreign Mineral Resource Estimate. The core material selected represented different rock types: semi and massive sulphides, quartz veins, diorite dyke, and fresh and altered anorthosite (refer to Figures 1 and 2 in Appendix C). The drill core was sampled by cutting a quarter split NQ core. The longer pieces of quarter split core were further manually broken down into 1 to 3 inches length to simulate a crushed product. The composite sample weighted 202 kg and graded 2.20% Cu and included an 18% external mining dilution from the hanging wall and foot wall of the mineralized interval.

The composite sample was then processed through the Steinert ore sorter and mixed with 26% of the unsorted underflow by-passed mineralized material to represent an overall sorted pre-concentrate mineralized material product (refer to Figure 4 in Appendix C). The composite resulted in a 123 kilogram sample with a grade of 3.31% Cu.

The resulting composite sample was evaluated through lock cycle tests to determine the flotation metallurgical performance (refer to Figure 4 in Appendix C). The sample was prepared to a nominal grind size of 140 microns K80 in the rougher testing and then processed through a regrind size of approximately 37 microns K80 in the cleaner tests.

The sample responded consistently throughout the test work with excellent performance to conventional flotation processing methods and reagents. Two locked cycle tests were completed with varying retention times to determine the concentrate grade versus recovery. The tests resulted in concentrate grades of 27.0% Cu and 29.6% Cu and recoveries 98.2% and 96.8%, respectively (refer to Table 1 below).

Minimal amounts of deleterious elements (e.g. arsenic, antimony, bismuth, cadmium etc.) were present in the concentrate, indicative of the ‘clean’ nature of the concentrate (refer to Table 2 below). These results showed the highly commercial quality of the concentrate in terms of salability and payment terms of smelters.

| Composite / Test |

Lock cycle test feed |

Concentrate |

Recovery |

| CBSP (sorted mineralized material) |

Cu % |

Au g/t |

Ag g/t |

Cu % |

Au g/t |

Ag g/t |

Cu % |

Au % |

Ag % |

| Lock Cycle Test 1 |

3.31 |

0.30 |

9 |

27 |

1.82 |

68 |

98.2 |

72.1 |

86.4 |

| Lock Cycle Test 2 |

3.28 |

0.55 |

10 |

29.6 |

3.24 |

72 |

96.8 |

62.6 |

76.9 |

Table 1. Corner Bay Metallurgical Test Work Results

| Composite / Test |

Impurity Elements (ppm) |

CBSP (sorted

mineralized material) |

Arsenic

(As) |

Antimony

(Sb) |

Bismuth

(Bi) |

Cadmium

(Cd) |

Lead

(Pb) |

Mercury

(Hg) |

Zinc

(Zn) |

| Lock Cycle Test 1 |

22 |

3 |

4 |

10 |

102 |

1 |

735 |

| Lock Cycle Test 2 |

10 |

3 |

3 |

10 |

88 |

1 |

777 |

Table 2. Corner Bay Impurity Element Content of Copper Concentrate

Other Metallurgical Test work

Other metallurgical recovery figures from the Company’s Chibougamau Project deposits are the following:

| Chibougamau Project Deposit |

Recovery Cu % |

Recovery Au % |

Metallurgical Testing / Processing |

| Devlin 1 |

95.5 |

72.5 |

1. 2021 flotation/locked cycle tests at SGS Canada Inc. mineral processing facility in Quebec City, Quebec. Composite sample from 3 HQ drill cores. 2

2. 2022 ore sorting test program at Corem mineral processing facility in Quebec City, Quebec. Composite sample from 4 HQ drill cores. 3

|

| Cedar Bay |

91 |

87 |

Production data prior to 1987. 4 |

| Joe Mann |

94.6 |

83.6 |

Production data from 2005-2007, prior to closure of mine. |

Notes:

- The Foreign Mineral Resource Estimate at the Devlin Project has the lowest gold concentration in the Chibougamau camp and therefore its contribution to recovered gold in the copper equivalent calculation is minimal.

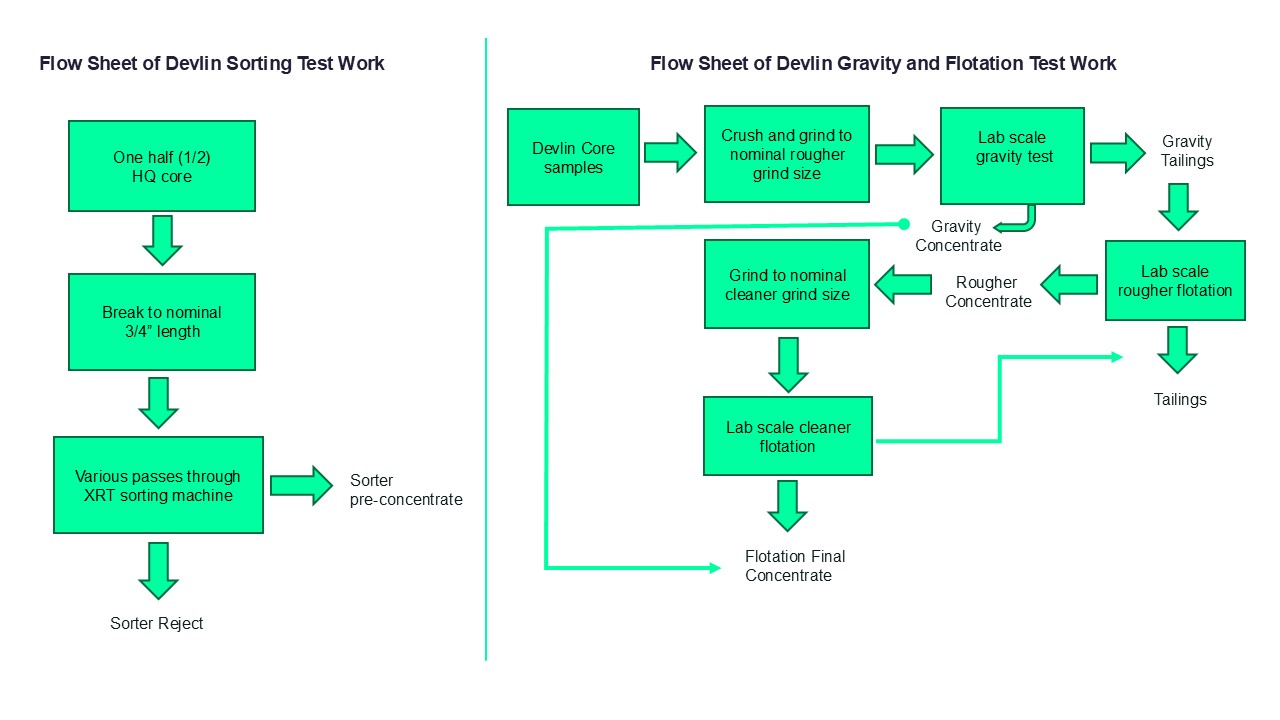

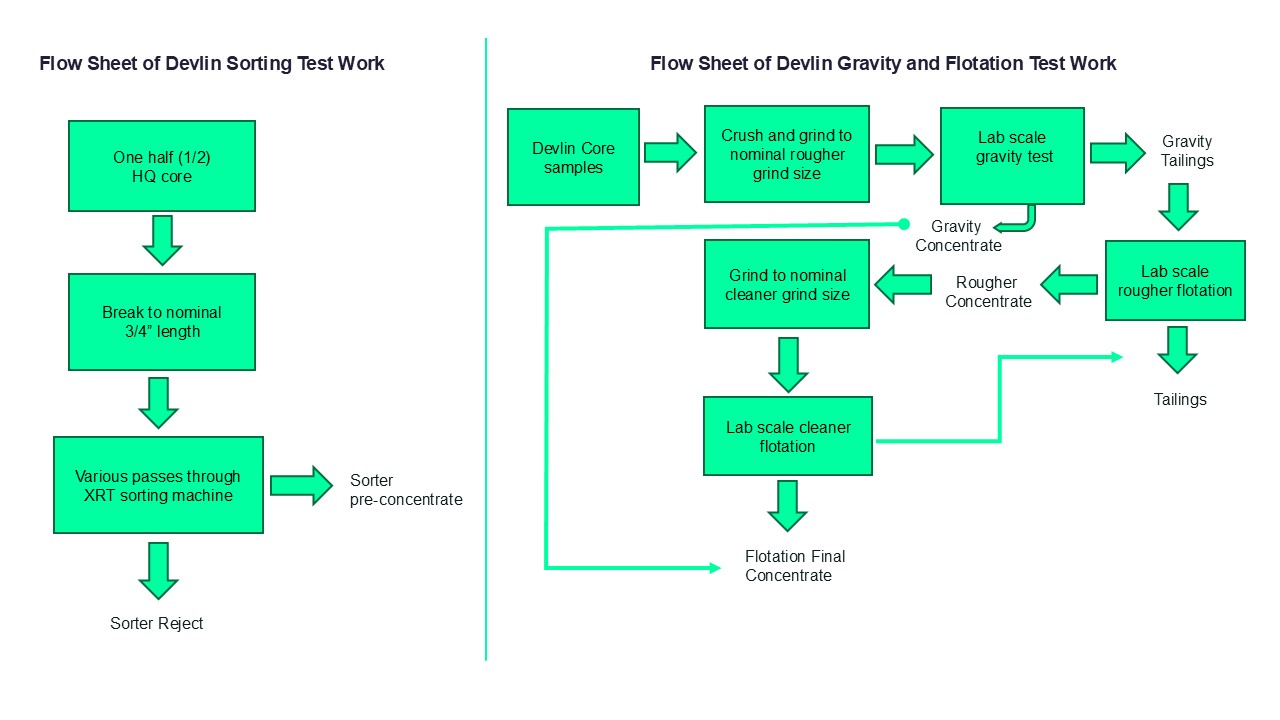

- The tests were conducted on a composite sample from three HQ holes drilled from the same drill pad. The composite assay indicated a grade of 1.70% Cu and 0.12g/t Au. The purpose of the gravity test was to evaluate the amenability of the material to gravity separation. A 14kg sample was ground to a P80 of approximately 200 μm prior to being fed to a Knelson concentrator at a rate of approximately 75 kg/h. The water flowrate was set at 3.5 L/min and the rotation speed was 60 G. The gold recovery was low at 11.6%. The tailings of the gravity separation test were used to perform flotation tests. A total of four flotation tests and one locked cycle test were performed. Ahead of each flotation test, a 2kg sample was ground to a P80 of approximately 125 µm. The results of each test were analysed, and Test 4 was identified as showing the best metallurgical performance with a copper grade of 28.3% and recovery of 90.8%. However, the gold recovery was low at 51.7% and the gold grade was less than 10g/t. Therefore, a locked cycle test was carried out to assess the stability of the Test 4 conditions. Six 1kg charges of minus 10 mesh (-2 mm) were used for the locked cycle test. The locked cycle tests yielded a concentrate grade at 20.5% Cu with 98.2% recovery and a gold recovery of 74.6%. Refer to Figures 3 and 5 in Appendix C.

- A sorting test was done on a crush sample of 3/4′ nominal size taken from four HQ drill ½ cores drilled in 2022 (all four holes drilled from the same pad) and material from three ½ HQ drill cores left from the 2021 metallurgical test work. The test results showed that particles of interest could be efficiently separated from the gangue. An overall copper recovery of 97.2% was achieved with an upgraded copper content from 2.95% to 4.82% Cu after three passes of sorting. Refer to Figures 3 and 5 in Appendix C.

- Internal company report of Campbell Resources dated 10 September 1987 and titled ‘Cedar Bay Shaft Deepening Project’.

This announcement has been authorised for release by the Board of Directors of Cygnus.

David Southam

Executive Chair

T: +61 8 6118 1627

E: info@cygnusmetals.com |

Ernest Mast

President & Managing Director

T: +1 647 921 0501

E: info@cygnusmetals.com |

Media:

Paul Armstrong

Read Corporate

T: +61 8 9388 1474 |

About Cygnus Metals

Cygnus Metals Limited (ASX: CY5, TSXV: CYG) is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

Forward Looking Statements

This document contains ‘forward-looking information’ and ‘forward-looking statements’ which are based on the assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of Cygnus believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as ‘expects’, ‘anticipates’, ‘plans’, ‘believes’, ‘estimates’, ‘seeks’, ‘intends’, ‘targets’, ‘projects’, ‘forecasts’, or negative versions thereof and other similar expressions, or future or conditional verbs such as ‘may’, ‘will’, ‘should’, ‘would’ and ‘could’. Although Cygnus and its management believe that the assumptions and expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of Cygnus to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, the actual results of current or future exploration, changes in project parameters as plans continue to be evaluated, changes in laws, regulations and practices, the geopolitical, economic, permitting and legal climate that Cygnus operates in, as well as those factors disclosed in Cygnus’ publicly filed documents. No representation or warranty is made as to the accuracy, completeness or reliability of the information, and readers should not place undue reliance on forward-looking information or rely on this document as a recommendation or forecast by Cygnus. Cygnus does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

End Notes

- The Mineral Resource estimate at the Chibougamau Project is a foreign estimate prepared in accordance with CIM Standards. A competent person has not done sufficient work to classify the foreign estimate as a mineral resource in accordance with the JORC Code, and it is uncertain whether further evaluation and exploration will result in an estimate reportable under the JORC Code. Refer to Appendix B for a breakdown of the Mineral Resource Estimate.

Competent Persons, Qualified Persons and Compliance Statements

The Exploration Results, scientific and technical information, including metallurgical test results, contained in this news release is based on and fairly represents information and supporting documentation compiled by Mr Ernest Mast, the Managing Director and President of Cygnus, a ‘qualified person’ as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr Mast holds shares and options in Cygnus. Mr Mast is a member of Ordre des ingenieurs du Quebec (P Eng), a Registered Overseas Professional Organisation as defined in the ASX Listing Rules, and has sufficient experience which is relevant to the style of mineralisation and type of deposits under consideration and to the activity which has been undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. The qualified person has provided his consent to be named in this announcement and consents to the form and context in which the scientific and technical information, including metallurgical test results has been presented in this market announcement.

The Company first announced the foreign estimate of mineralisation for the Chibougamau Project on 15 October 2024. The Company confirms that the supporting information included in the announcement of 15 October 2024 continues to apply and has not materially changed, notwithstanding the clarification announcement released by Cygnus on 28 January 2025 (‘Clarification’). Cygnus confirms that (notwithstanding the Clarification) it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the estimates in the original announcement continue to apply and have not materially changed. Cygnus confirms that its is not in possession of any new information or data that materially impacts on the reliability of the estimates or Cygnus’ ability to verify the foreign estimates as mineral resources in accordance with the JORC Code. The Company confirms that the form and context in which the Competent Persons’ findings are presented have not been materially modified from the original market announcement.

Metal equivalents for the foreign estimate have been calculated at a copper price of US$8,750/t, gold price of US$2,350/oz, copper equivalents calculated based on the formula CuEq (%) = Cu(%) + (Au (g/t) x 0.77258). Metallurgical recovery factors have been applied to the copper equivalents calculations, with copper metallurgical recovery assumed at 95% and gold metallurgical recovery assumed at 85% based upon historical production at the Chibougamau Processing Facility, and the metallurgical results contained in this announcement. It is the Company’s view that all elements in the copper equivalent calculations have a reasonable potential to be recovered and sold.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

APPENDIX A – Drill Hole Location and Sampling Intervals for the Significant Intersections and for the Metallurgical Test Work

Coordinates given in UTM NAD83 (Zone 18).

Corner Bay Metallurgical Test Work

A total of 34 diamond drill core were used for the Corner Bay composite sample. The table shows the sampling interval for each hole collected for the composite sample (sample type: Metallurgy) and the significant intersection obtained through assaying the sample (sample type: Assay). N/A means Not Applicable and na means Not Assayed.

| Hole ID |

X |

Y |

Z |

Azi |

Dip |

Depth (m) |

Sample Type |

From (m) |

To (m) |

Interval (m) |

Cu % |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

| CB-18-03 |

554555 |

5510226 |

380 |

121.1 |

-71.6 |

912.0 |

Metallurgy |

849.5 |

854.6 |

5.1 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

850.0 |

854.15 |

4.15 |

4.29 |

0.13 |

14.6 |

na |

| CB-18-05 |

544550 |

5510181 |

380 |

125.5 |

-75.9 |

1,092.0 |

Metallurgy |

1,022.3 |

1,030.3 |

8.0 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,023.0 |

1029.6 |

6.55 |

4.11 |

0.14 |

8.8 |

na |

| CB-18-06 |

554555 |

5510181 |

380 |

125.9 |

-74.9 |

987.0 |

Metallurgy |

948.2 |

963.2 |

15.0 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

949.5 |

961.8 |

12.3 |

2.33 |

0.12 |

5.5 |

na |

| CB-18-07 |

554555 |

5510181 |

380 |

126.2 |

-72.8 |

897.7 |

Metallurgy |

851.6 |

867.9 |

16.2 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

853.1 |

866.4 |

13.3 |

3.45 |

0.29 |

12.1 |

na |

| CB-19-11 |

554556 |

5510227 |

380 |

97 |

-60 |

1011.0 |

Metallurgy |

757.1 |

759.2 |

2.1 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

781.2 |

781.7 |

0.5 |

6.16 |

0.43 |

30.0 |

na |

| CB-20-13 |

554259 |

5510036 |

383 |

97 |

-56 |

945.0 |

Metallurgy |

862.4 |

863.2 |

0.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

862.5 |

863.1 |

0.6 |

1.89 |

0.10 |

4.0 |

na |

|

|

|

|

|

|

|

Metallurgy |

907.1 |

910.4 |

3.3 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

907.4 |

910.1 |

2.7 |

1.40 |

0.05 |

7.3 |

na |

| CB-20-15 |

554236 |

5509858 |

382 |

77 |

-66 |

1,200.0 |

Metallurgy |

1,065.3 |

1,074.4 |

9.1 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,066.15 |

1,073.6 |

7.45 |

2.38 |

0.12 |

4.2 |

na |

|

|

|

|

|

|

|

Assay |

1,068.95 |

1,072.6 |

3.65 |

3.65 |

0.18 |

6.2 |

na |

| CB-20-16W1 |

554259 |

5510036 |

383 |

87 |

-71 |

1,230.0 |

Metallurgy |

1,156.6 |

1,159.7 |

4.0 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,156.0 |

1,158.3 |

3.3 |

1.94 |

0.13 |

4.5 |

na |

| CB-20-18 |

554236 |

5509858 |

382 |

90 |

-66 |

1,049.9 |

Metallurgy |

1,021.2 |

1,028.9 |

7.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,021.9 |

1,028.2 |

6.30 |

3.03 |

0.11 |

6.6 |

na |

| CB-20-19 |

554236 |

5509858 |

382 |

84 |

-70 |

1,185.0 |

Metallurgy |

1,160.0 |

1,167.9 |

7.9 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,160.75 |

1,167.2 |

6.45 |

4.06 |

0.38 |

13.2 |

na |

|

|

|

|

|

|

|

Assay |

1,164.85 |

1,167.2 |

2.35 |

6.10 |

0.74 |

15.3 |

na |

| CB-21-25 |

554572 |

5510607 |

378 |

112 |

-56 |

798.0 |

Assay |

634.4 |

640.4 |

6.0 |

1.75 |

0.09 |

5.4 |

na |

|

|

|

|

|

|

|

Assay |

636.2 |

640.4 |

4.2 |

2.13 |

0.11 |

6.7 |

na |

|

|

|

|

|

|

|

Metallurgy |

766.6 |

767.6 |

1.0 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

766.65 |

767.5 |

0.85 |

0.48 |

0.04 |

4.7 |

na |

| CB-21-28 |

554199 |

5509800 |

383 |

89 |

-69 |

1,164.0 |

Metallurgy |

1,146.3 |

1,150.8 |

4.5 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,146.7 |

1,150.4 |

3.7 |

5.05 |

0.15 |

11.3 |

na |

|

|

|

|

|

|

|

Assay |

1,147.2 |

1,149.0 |

1.8 |

9.12 |

0.17 |

19.2 |

na |

| CB-21-29 |

554198 |

5509781 |

383 |

90 |

-65 |

1,068.0 |

Metallurgy |

1,050.2 |

1,054.7 |

4.5 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,050.6 |

1,054.3 |

3.7 |

2.47 |

0.87 |

9.3 |

na |

|

|

|

|

|

|

|

Assay |

1,051.6 |

1,053.1 |

1.5 |

5.25 |

2.05 |

12.7 |

na |

| CB-21-30 |

554198 |

5509781 |

383 |

90 |

-65 |

1,068.0 |

Metallurgy |

1,007.2 |

1,016.3 |

9.1 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,005.0 |

1,015.45 |

10.45 |

2.23 |

0.52 |

7.7 |

na |

|

|

|

|

|

|

|

Assay |

1,010.3 |

1,014.9 |

4.6 |

4.04 |

1.02 |

13.7 |

na |

| CB-21-32 |

554673 |

5510019 |

396 |

90 |

-57 |

641.4 |

Metallurgy |

1,118.9 |

1,125.6 |

6.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,119.5 |

1,125.0 |

5.5 |

3.46 |

0.25 |

8.4 |

na |

|

|

|

|

|

|

|

Assay |

1,120.4 |

1,124.0 |

3.6 |

4.63 |

0.30 |

11.4 |

na |

| CB-21-32W1 |

554198 |

5509781 |

383 |

105 |

-68 |

1,149.0 |

Metallurgy |

1,069.4 |

1,086.8 |

17.3 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1071.0 |

1085.2 |

14.2 |

2.26 |

0.18 |

7.4 |

na |

|

|

|

|

|

|

|

Assay |

1071.8 |

1078.6 |

6.8 |

3.67 |

0.26 |

9.7 |

na |

| CB-21-32W2 |

554198 |

5509781 |

383 |

105 |

-68 |

1,155.0 |

Metallurgy |

1,035.5 |

1,047.3 |

11.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1036.6 |

1046.2 |

9.6 |

2.19 |

0.20 |

6.58 |

na |

|

|

|

|

|

|

|

Assay |

1043.6 |

1046.2 |

2.6 |

5.86 |

0.66 |

14.75 |

na |

| CB-21-34 |

554257 |

5510030 |

381 |

75.0 |

-65.0 |

1204.0 |

Metallurgy |

1,159.8 |

1,164.2 |

4.4 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,160.2 |

1,163.8 |

3.6 |

4.52 |

0.12 |

8.1 |

na |

|

|

|

|

|

|

|

Assay |

1,161.2 |

1,162.85 |

1.65 |

9.75 |

0.24 |

14.7 |

na |

| CB-21-35 |

554674 |

5510020 |

398 |

100.0 |

-56.0 |

468.0 |

Metallurgy |

427.0 |

435.9 |

8.9 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

427.8 |

435.1 |

7.3 |

1.43 |

0.17 |

4.9 |

na |

|

|

|

|

|

|

|

Assay |

431.5 |

434.6 |

3.1 |

2.03 |

0.32 |

6.6 |

na |

| CB-21-36 |

554618 |

5510020 |

394 |

95.0 |

-63.0 |

633.0 |

Metallurgy |

607.5 |

610.7 |

3.2 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

607.8 |

610.4 |

2.6 |

1.35 |

0.22 |

10.2 |

na |

| CB-21-41 |

554198 |

5509781 |

383 |

92.0 |

-60.0 |

1050.0 |

Metallurgy |

967.2 |

971.5 |

4.3 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

967.6 |

971.1 |

3.5 |

2.66 |

0.40 |

16.6 |

195 |

| CB-21-42 |

554198 |

5509781 |

383 |

110.0 |

-63.0 |

1125.6 |

Metallurgy |

1,044.7 |

1,048.3 |

3.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,045.0 |

1,048.0 |

3.0 |

2.71 |

0.18 |

22.3 |

– |

| CB-21-48 |

554198 |

5509781 |

383 |

95.0 |

-72.0 |

1311.0 |

Metallurgy |

1,261.0 |

1,264.1 |

3.0 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,261.3 |

1,263.8 |

2.5 |

2.42 |

0.15 |

– |

– |

| CB-21-51 |

554257 |

5510030 |

381 |

60.0 |

-56.0 |

1188.0 |

Metallurgy |

1,140.9 |

1,147.5 |

6.6 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,141.5 |

1,146.9 |

5.4 |

2.24 |

0.10 |

– |

142 |

|

|

|

|

|

|

|

Assay |

1,144.0 |

1,146.9 |

2.9 |

3.44 |

0.17 |

– |

262 |

| CB-21-53 |

554618 |

5510020 |

394 |

135.0 |

-60.0 |

804.0 |

Metallurgy |

768.1 |

770.5 |

2.4 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

768.3 |

770.3 |

2.0 |

3.34 |

0.56 |

15.6 |

– |

| CB-21-55 |

554618 |

5510020 |

394 |

100.0 |

-68.0 |

729.0 |

Metallurgy |

673.3 |

678.0 |

4.8 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

673.7 |

677.6 |

3.9 |

8.03 |

0.86 |

42.1 |

1,109 |

| CB-21-56 |

554257 |

5510030 |

381 |

56.0 |

-66.0 |

1374.0 |

Metallurgy |

1,293.7 |

1,297.3 |

3.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,294.0 |

1,297.0 |

3.0 |

2.10 |

0.10 |

– |

– |

| CB-21-57 |

554618 |

5510020 |

394 |

118.0 |

-70.0 |

747.0 |

Metallurgy |

719.5 |

724.7 |

5.1 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

720.0 |

724.2 |

4.2 |

6.18 |

0.12 |

26.6 |

271 |

| CB-22-70 |

554562 |

5510292 |

380 |

96.0 |

-52.0 |

693.0 |

Metallurgy |

628.1 |

632.4 |

4.3 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

628.5 |

632.0 |

3.5 |

1.03 |

0.06 |

7.4 |

– |

| CB-22-74 |

554264 |

5510035 |

384 |

90.1 |

-62.0 |

1041.0 |

Metallurgy |

982.4 |

984.9 |

2.6 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

982.6 |

984.7 |

2.1 |

1.19 |

0.16 |

4.8 |

132 |

| CB-22-76 |

554236 |

5509858 |

382 |

86.5 |

-61.0 |

999.0 |

Metallurgy |

954.2 |

960.8 |

6.6 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

954.8 |

960.2 |

5.4 |

3.37 |

1.00 |

23.7 |

1,597 |

| CB-22-78 |

554258 |

5510033 |

380 |

89.5 |

65.0 |

1110.0 |

Metallurgy |

1,048.6 |

1,054.3 |

5.7 |

N/A |

N/A |

N/A |

N/A |

|

|

|

|

|

|

|

Assay |

1,049.1 |

1,053.8 |

4.7 |

2.30 |

0.14 |

7.7 |

150 |

Notes:

- From hole CB-19-08 to CB-21-38 and from CB-22-70 to CB-22-78, the true width of the structures intersected is estimated at approximately 55-65% of the downhole width.

- From hole CB-21-39 to CB-21-57, the true width of the structures intersected is estimated at approximately 60-75% of the downhole width. For holes CB-21-48, the true width of the structures intersected is estimated at approximately 55-60% of the downhole width.

Devlin Metallurgical Test Work

A total of 3 HQ diamond drill ½ core were used for the Devlin composite sample for the 2021 flotation tests. A total of 4 HQ diamond drill ½ core and material left from the 2021 metallurgical test work (the other ½ drill cores from the 3 HQ holes) were used for the Devlin composite sample for the 2022 ore sorting tests. The table shows the sampling interval for each hole collected for the composite sample (sample type: Flotation or Ore Sorting).

| Hole ID |

X |

Y |

Z |

Azi |

Dip |

Depth (m) |

Sample Type |

From (m) |

To (m) |

Interval (m) |

| DV-21-01 |

548063 |

5511863 |

380 |

333 |

-50 |

120 |

Flotation |

87.4 |

89.7 |

2.3 |

| DV-21-02 |

548063 |

5511863 |

380 |

360 |

-90 |

102 |

Flotation |

65.8 |

68.1 |

2.3 |

| DV-21-03 |

548063 |

5511863 |

380 |

29 |

-50 |

111 |

Flotation |

92.8 |

95.1 |

2.3 |

| DV-22-04 |

548083 |

5511859 |

380 |

0 |

-90 |

84 |

Ore Sorting |

64.5 |

66.8 |

2.3 |

| DV-22-05 |

548083 |

5511859 |

380 |

0 |

-90 |

84 |

Ore Sorting |

64.8 |

67.1 |

2.3 |

| DV-22-06 |

548083 |

5511859 |

380 |

0 |

-70 |

84 |

Ore Sorting |

68.8 |

71.1 |

2.3 |

| DV-22-07 |

548083 |

5511859 |

380 |

0 |

-70 |

84 |

Ore Sorting |

69 |

71.3 |

2.3 |

APPENDIX B – Chibougamau Copper-Gold Project – Foreign Mineral Resource Estimate Disclosures as at 30 March 2022

| Deposit |

Category |

Tonnes

(k) |

Cu Grade

(%) |

Au Grade

(g/t) |

Cu Metal

(kt) |

Au Metal

(koz) |

CuEq Grade

(%) |

| Corner Bay (2022)

|

Indicated |

2,700 |

2.7 |

0.3 |

71 |

22 |

2.9 |

| Inferred |

5,900 |

3.4 |

0.3 |

201 |

51 |

3.6 |

| Devlin (2022)

|

Measured |

120 |

2.7 |

0.3 |

3 |

1 |

2.9 |

| Indicated |

660 |

2.1 |

0.2 |

14 |

4 |

2.3 |

| Measured & Indicated |

780 |

2.2 |

0.2 |

17 |

5 |

2.4 |

| Inferred |

480 |

1.8 |

0.2 |

9 |

3 |

2.0 |

| Joe Mann (2022) |

Inferred |

610 |

0.2 |

6.8 |

1 |

133 |

5.5 |

| Cedar Bay (2018)

|

Indicated |

130 |

1.6 |

9.4 |

2 |

39 |

8.9 |

| Inferred |

230 |

2.1 |

8.3 |

5 |

61 |

8.5 |

| Total |

Measured & Indicated |

3,600 |

2.5 |

0.6 |

90 |

66 |

3.0 |

| Total |

Inferred |

7,200 |

3.0 |

1.1 |

216 |

248 |

3.8 |

APPENDIX C – 2012 JORC Table 1

Section 1 Sampling Techniques and Data

| Criteria |

JORC Code explanation |

Commentary |

| Sampling techniques

|

Nature and quality of sampling (eg cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc). These examples should not be taken as limiting the broad meaning of sampling. |

- Material used for the metallurgical samples was selected from 34 holes at Corner Bay:

- Samples were quarter NQ core with a total weight of 202kg. The core material selected represented different rock types: semi and massive sulphides, quartz veins, diorite dyke, and fresh and altered anorthosite.

- Diamond core was previously cut using a core saw on site. Trays with the remaining half core selected intervals were sent to Base Metallurgical Laboratories in Kamloops, British Columbia for defined metallurgical test work.

- Material used for the metallurgical samples at Devlin:

- 2021 test: material selected from 3 HQ drill cores; samples were half HQ core weighing 2kg for each sample. Material sent to Corem mineral processing facility in Quebec City, Canada for defined metallurgical test work.

- 2022 test: material selected 4 HQ drill ½ cores drilled in 2022 and material from three ½ HQ drill cores from 2021. Material sent to SGS Canada Inc. mineral processing in Quebec City, Canada for defined metallurgical test work.

- Diamond core was cut using a core saw on site. Trays with the remaining half core remained at site.

|

| Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. |

- NQ and HQ core was marked for splitting during logging and is sawn using a diamond core saw with a mounted jig to assure the core is cut lengthwise into equal halves.

|

| Aspects of the determination of mineralisation that are Material to the Public Report.

In cases where ‘industry standard’ work has been done this would be relatively simple (eg ‘reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay’). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information.

|

- Industry standard sampling practices were used with sample lengths ranging from 0.3 m to 1.0 m and respected geological contacts. Sample tags were placed at the beginning of each sample interval and the tag numbers were recorded in an MS Excel database.

- Sampling practice is considered to be appropriate to the geology and style of mineralisation.

|

| Drilling techniques |

Drill type (eg core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (eg core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc). |

- Material for the metallurgical test work used diamond core exclusively.

- At Corner Bay the core size was NQ, quarter-cut.

- At Devlin the core size was HQ, half-cut.

- All samples were originally oriented by Company geologists.

|

| Drill sample recovery |

Method of recording and assessing core and chip sample recoveries and results assessed.

Measures taken to maximise sample recovery and ensure representative nature of the samples.

Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material.

|

- Diamond core recovery was measured for each run and calculated as a percentage of the drilled interval.

- Overall, the core recoveries are excellent in the Chibougamau area.

|

| Logging

|

Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. |

- All core was geologically and geotechnically logged. Lithology, veining, alteration and mineralisation are recorded in multiple tables of the drillhole database

|

| Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. |

- Geological logging of core is qualitative and descriptive in nature.

|

| The total length and percentage of the relevant intersections logged. |

- 100% of the core has been logged.

|

| Sub-sampling techniques and sample preparation |

If core, whether cut or sawn and whether quarter, half or all core taken.

If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry.

For all sample types, the nature, quality and appropriateness of the sample preparation technique.

Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples.

Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling.

Whether sample sizes are appropriate to the grain size of the material being sampled.

|

- Core was cut in half using conventional diamond core saw. Half was sent for initial analysis with the remainder was quarter cored with half retained and half used for metallurgical test work.

- Sample intervals are based on geological intervals ranging from 30cm to 1m.

- This sampling technique is industry standard and deemed appropriate.

|

| Quality of assay data and laboratory tests

|

The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. |

- Sample preparation was done at SGS Canada Inc. (‘SGS’) in Val-d’Or, Québec and Burnaby, B.C. and fire assay and ICP analysis was done at SGS in Burnaby, B.C.

- Samples were weighed, dried, crushed to 75% passing 2 mm, split to 250 g, and pulverized to 85% passing 75 microns.

- Samples were then fire assayed for Au (50 g) and sodium peroxide fusion ICP-MS finish for 34 elements.

|

| For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. |

|

| Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

- Laboratory QC procedures involve the use of internal certified reference material as assay standards, along with blanks, duplicates and replicates.

|

| Verification of sampling and assaying

|

The verification of significant intersections by either independent or alternative company personnel. |

|

| The use of twinned holes. |

|

| Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. |

- All logging data was completed, core marked up, logging and sampling data was entered directly into the database.

- The logged data is stored on the site server directly.

|

| Discuss any adjustment to assay data. |

- There was no adjustment to the assay data.

|

| Location of data points

|

Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. |

- The location of the drillholes and the aiming points for the orientation of the drillholes were indicated on the ground using identified stakes. The stakes marking the location of the drillholes were set up and located with a Garmin GPS model ‘GPSmap 62s’ (4m accuracy).