Walker Lane Resources Ltd. (TSX-V:WLR, FRA: 6YL) (the ‘Company’ or ‘Walker Lane’) is pleased to announce that is has received results from Coeur Silvertip Holdings Ltd. (‘Coeur’) on field geophysical and geological studies completed in late 2024 on the Silverknife Property, British Columbia. Coeur contracted Expert Geophysics Limited (‘Expert’) and Precision Geophysics (‘Precision’) to complete the airborne geophysical surveys, and 39627 Yukon Inc. to complete geological mapping of the Silverknife Property and an initial geochemical survey of the northern portion of the property.

This work was completed by Coeur as a part of the option agreement for the Silverknife Property with Walker Lane. The four-year option agreement provides for $3.55 million in work expenditures and $500,000 in property payments by Coeur to earn a 75% interest in the Silverknife Property which is immediately adjacent to Coeur’s Silvertip Mine claims.

The primary results of these work efforts are:

- The geological map of the property is now significantly revised and better defines the location of prospective lithological units;

- The geophysical surveys served to:

- Define the presence of complex fault structures;

- Present additional conductivity data;

- Identify a potential new prospective zone in the northeastern section of the property; and

- Enhance the continued prospectivity of the Tootsee River North, Silverknife Central and Silverknife South zones of exploration prospectivity.

Kevin Brewer, President and CEO of Walker Lane noted, ‘We are very pleased with that the geological mapping and airborne geophysics has clearly served to better define and confirm the zones of exploration prospectivity. This work identified key structural features such as faults which are known in the region to be controls and loci of mineralization. Other features such the presence of fugitive calcite in outcrops typically demonstrates that you are in close proximity toa potential carbonate replacement deposit (‘CRD’). The four prospective areas on the Silverknife property are both significant and of substantial areal extent and present valid drill targets for future exploration efforts. The property has been subjected to limited drilling confined primarily to the Silverknife Prospect that in itself remains open for further expansion along strike and at depth. Given the propensity of potential mineralization in such close proximity to the Silvertip deposit, one of the world’s largest and highest grade CRD deposits, finding this much prospectivity is a very exciting development. There clearly is a great amount of work to be completed at Silverknife. We look forward to Coeur’s continued commitment to explore Silverknife, which may include some drilling.’

Precision Geophysics – Airborne High Resolution Gradient Magnetic and Radiometric Survey Results

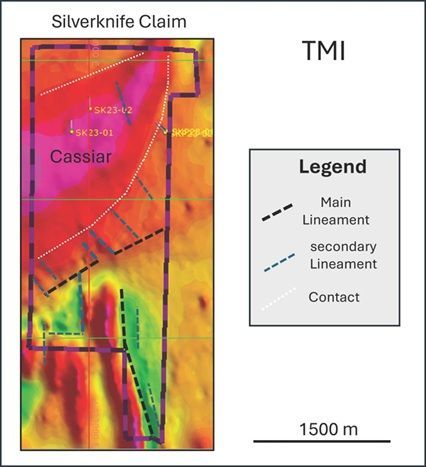

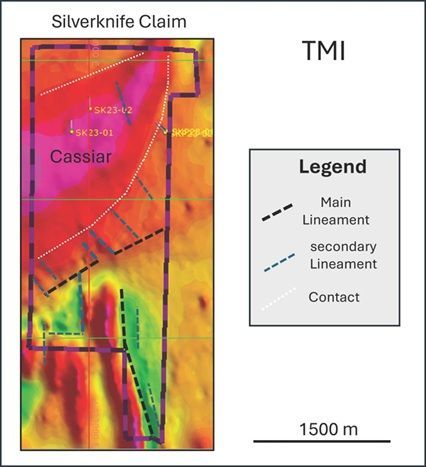

When magnetic and radiometric data are integrated into a single-pass airborne geophysical survey, they provide complimentary information that serve as a robust geophysical framework. The magnetic and radiometric data collected by Precision was useful in mapping lithology, structure and alteration features present on the Silverknife Property. The Total Magnetic Intensity (‘TMI’) data (see Figure 1) indicated the potential existence of three main lineaments within the Silverknife Property. In the instance of Silverknife, the lineaments express underlying geological structures such as faults. Faults are important as they present corridors for the migration of mineralizing fluids. Two lineaments, northeasterly and northwesterly trending are prominent throughout the property area. The third lineament is a more northerly feature that occurs in the area of the Silverknife Property. The most prominent structural feature identified from the TMI data, was a northeasterly trending structure known as the SVT NE Fault, which is a major regional fault that transects the central portion of the Silverknife Property. In this area, the SVT NE Fault and the secondary lineaments appear to be in a cross-cutting relationship which are often prime target areas for mineralization, and are considered highly prospective as the coincide with historical soil geochemical anomalies in the Silverknife Central Zone. Geological mapping has also indicated the presence of Atan and Kechika Group limestones in this area which are favorable rock units to host carbonate replacement deposits. The Silvertip mine is characterized as a carbonate replacement deposit. In addition, the potential of additional structures throughout the Silverknife Central Zone to the western boundary of the Silverknife claims presents numerous targets for drilling and expansion of mineralization identified in the Silverknife Property, and this area is yet to be drilled.

Figure 1: Total Magnetic Intensity survey with geological and structural interpretation by Symonds (2024). Note the potential cross cutting fault structures in the central portion of the property (after Precision, 2024).

The Precision TMI data also indicated a near-north trending fault that cuts the McDame Limestones and Tapioca Group in the Silverknife South Zone. The TMI data was complimented by Residual Magnetic Intensity (‘RMI’) and Reduced to Magnetic Pole (‘RTP’) that also showed the same structural lineaments.

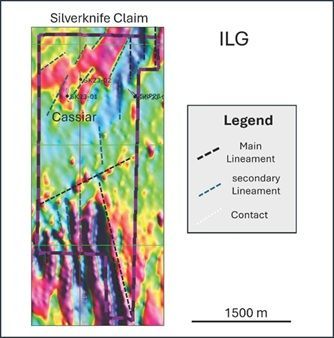

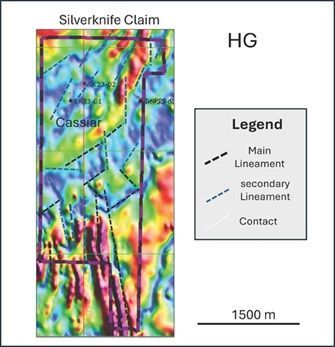

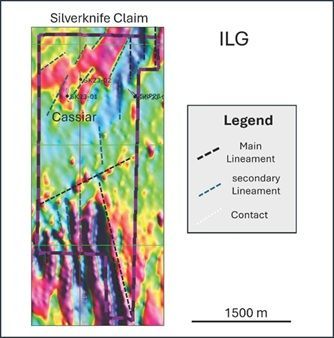

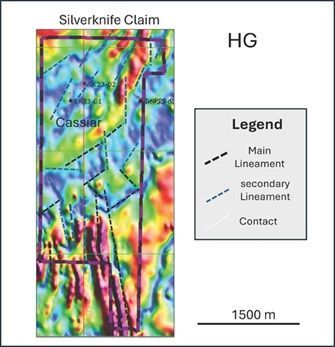

In-line gradient (‘ILG’) and horizontal gradient showed the same structure features as the TMI data (see Figures 2a and 2b).

Figure 2a: In Line gradient survey (ILG) with lineament interpretation in the Silverknife region (After Precision, 2024).

Figure 2b: Horizontal Gradient (HG) with lineament interpretation in the Silverknife region (After Precision, 2024).

However, they also showed the potential for more complex faulting along the southern and northern contacts of the Cassiar batholith that could represent block faulting in the metasediments. In addition, this data showed the presence of a north-oriented structure in the northeastern most portion of the Silverknife Property, that presented a new area of exploration prospectivity previously undetected.

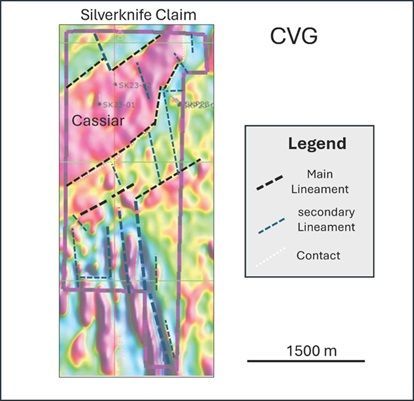

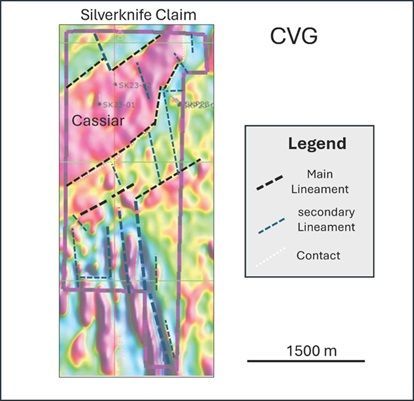

Calculated Vertical Gradient (‘CVG’) data (see Figure 3) presented a distinct continuum of structures extending from south of the Silverknife Property into the Silverknife South Zone.

Figure 3: Calculated Vertical Gradient (CVG) with lineament interpretation of the Silverknife region (after Precision, 2024).

The radiometric data serves to delineate the extent and potential contacts of different lithological rock units. Areas of high potassium were noted to occur in the Tootsee River North and the Northeastern zones. The significance of this data is not yet determined.

Expert Geophysics Helicopter-Borne Electromagnetic and Magnetic Survey Results

Electromagnetic and magnetic surveys were carried out to:

- Provide data to aid in mapping bedrock structures and lithologies, including possible alteration and mineralization zones;

- Provide observations of apparent conductivity corresponding to different frequencies;

- Inverting EM data to obtain the distribution of resistivity with depth; and

- Collecting VLF-EM and magnetic data to study properties of the bedrock units.

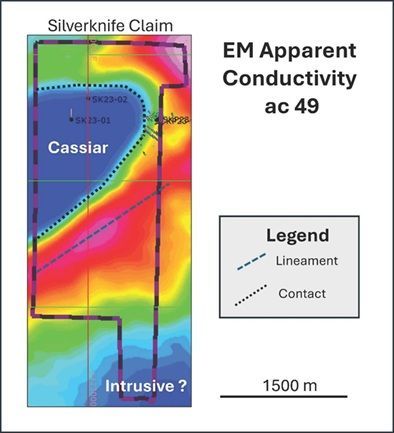

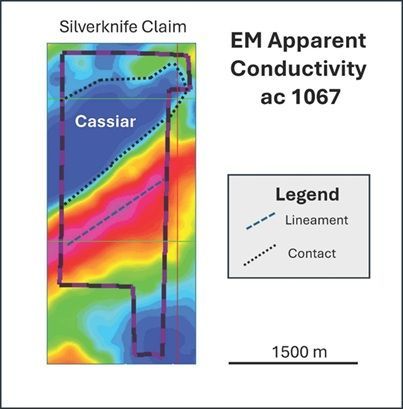

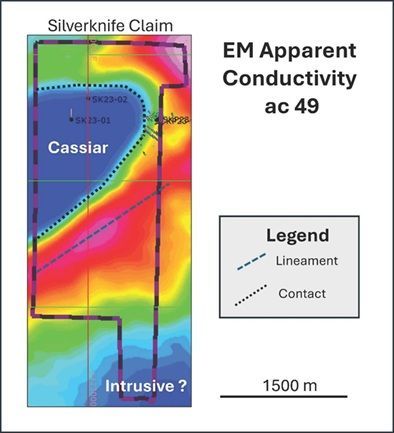

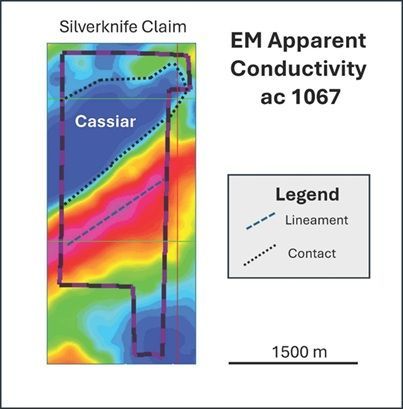

The electromagnetic survey verified information from the data in Precision’s surveys but also identified new information (see Figures 4a and 4b). A conductivity low south-southeast of the Silverknife Property suggests the presence of a near surface intrusive in that area. This is important because an intrusive provides a potential heat source and driver for mineralizing fluids into the overlying sediments which comprise of limestones and sandstone which are good hosts for CRD mineralization. The survey also indicated a conductivity high in the northeastern zone further strengthening exploration interest in that area.

Figure 4a: Electromagnetic apparent conductivity at 49 Hz in the Silverknife region. Note the anomaly in the northeastern part of the property (After EGL, 2024).

Figure 4b: Electromagnetic apparent conductivity at 1067 Hz in the Silverknife region (After EGL, 2024).

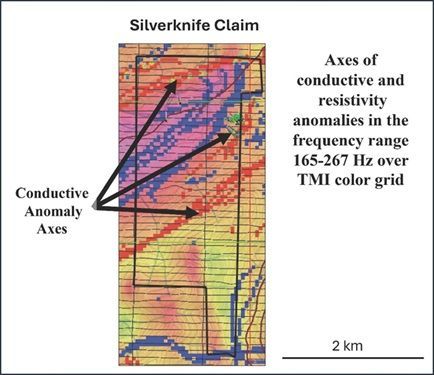

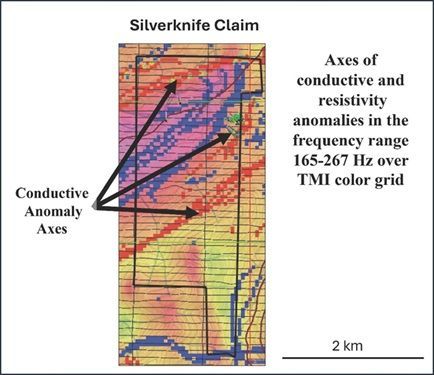

Several axes of high conductivity/low resistivity were found to transect the Silverknife Property and are coincident with interpreted fault structures (see Figure 5). This relationship is important as mineralization within the Rancheria Silver District is often associated with faults and may also be correlated with the axes of a conductivity anomaly.

Three conductive axes occur in the (i) Tootsee River North Zone; (ii) the Silverknife Central Zone; and (iii) coincident with the regional SVT NE Fault structure that transects the central portion of the property. This last axis extends from outside of the Silverknife claim block and thence east-northeasterly across the entire claim block. This therefore represents the potential for a major fault structure with the geophysical signatures of silver rich CRD being that of high conductivity and low resistivity. Additional resistivity data enabled the development of a three-dimensional lithographic model suggesting the orientation and extent of the rock units within the Silverknife Property. This information is expected to significantly aid the planning of future drill programs.

VLF-EM data served to further verify other datasets as to the possible extent and location of fault structures within the Silverknife Property.

Figure 5: Axes of conductive and resistivity anomalies in the frequency range of 165-267 Hz plotted on a Total Magnetic Intensity color grid (After EGL, 2024).

Geological Mapping

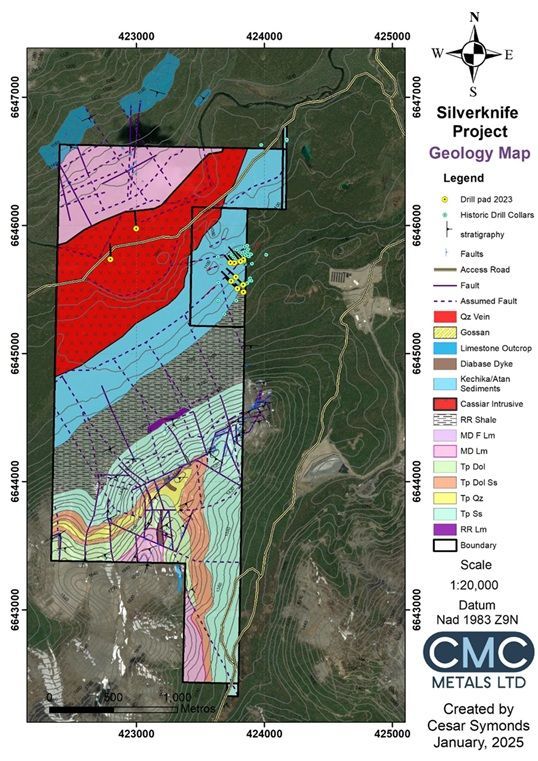

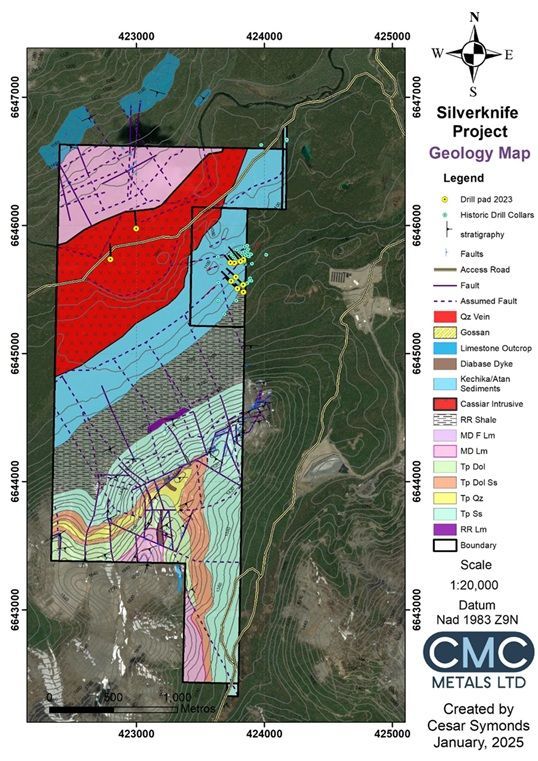

An updated geological map (see Figure 6) has been constructed from field mapping, drill data, and geophysical surveys. The extent of prospective units to host CRD mineralization has been found to be considerable. More specifically, the highly prospective McDame limestone occurs in both the Tootsee River North Zone and the Silverknife South Zone. Other prospective units in the central part of the property including the Atan and Kechika Group limestones occur within the central portion of the property which is now assumed to be of significant prospectivity from previous known CRD mineralization, and positive geochemical and geophysical signatures.

Summary

This recent geophysical work in combination with property mapping and previous geophysical data has contributed significantly to the understanding of the geology of the Silverknife Property. It has also contributed significantly to better defining targets for CRD mineralization and assisting to pinpoint targets for extensive drill campaigns.

Figure 6 : Geology Map of the Silverknife Property (After Symonds, 2024)

Clarification of Nevada Transactions

The Company wishes to clarify that in its June 9, 2025 Press release all payments to be made to the optionors are to be made in US Dollars, the floor price for the shares that may be used to make property payments is also in US dollars at $0.21 USD, and the maximum number of common shares that could be issued by property are as follows:

- Tule Canyon: 952,381

- Cambridge: 500,000

- Silver Mountain: 500,000

for a total number of common shares that could be issued to be 1,952,381 for the life of the agreements.

Qualified Person

Kevin Brewer, a registered professional geoscientist, is the Company’s President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has given his approval of the technical information reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

About Walker Lane Resources Ltd.

Walker Lane Resources Ltd. is a growth-stage exploration company focused on the exploration of high-grade gold, silver and polymetallic deposits in the Walker Lane Gold Trend District in Nevada and the Rancheria Silver District in Yukon/B.C. and other property assets in Yukon. The Company intends to initiate exploration programs to advance the drill-ready Tule Canyon (Walker Lane, Nevada) and Amy (Rancheria Silver, B.C.) projects to resource definition stage through proposed drilling campaigns that the Company desires to undertake in the near future.

On behalf of the Board:

‘Kevin Brewer’

Kevin Brewer, President, CEO and Director

Walker Lane Resources Ltd.

For Further Information and Investor Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc. (Hons), Dip. Mine Eng.

President, CEO and Director

Tel: (709) 327 8013

kbrewer80@hotmail.com

Suite 1600-409 Granville St.,

Vancouver, BC, V6C 1T2

Cautionary and Forward-Looking Statements

This press release and related figures, contain certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to as forward-looking statements). These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words ‘anticipate’, ‘plans’, ‘continue’, ‘estimate’, ‘expect’, ‘may’, ‘will’, ‘project’, ‘predict’, ‘potential’, ‘should’, ‘believe’ ‘targeted’, ‘can’, ‘anticipates’, ‘intends’, ‘likely’, ‘should’, ‘could’ or grammatical variations thereof and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These statements speak only as of the date of this presentation. These forward-looking statements include, but are not limited to, statements concerning: our strategy and priorities including certain statements included in this presentation are forward-looking statements within the meaning of Canadian securities laws, including statements regarding the Tule Canyon, Cambridge, Silver Mountain, and Shamrock Properties in Nevada (USA), and its properties including Silverknife and Amy properties in British Columbia, the Silver Hart, Blue Heaven and Logjam properties in Yukon all of which now comprise the mineral property assets of WLR. WLR has assumed other assets of CMC Metals Ltd. including common share holdings of North Bay Resources Inc. and all conditions and agreements pertaining to the sale of the Bishop mill gold processing facility and remains subject to the condition of the option of the Silverknife Property with Coeur Silvertip Holdings Ltd. These forward-looking statements reflect the Company’s current beliefs and are based on information currently available to the Company and assumptions the Company believes are reasonable. The Company has made various assumptions, including, among others, that: the historical information related to the Company’s properties is reliable; the Company’s operations are not disrupted or delayed by unusual geological or technical problems; the Company has the ability to explore the Company’s properties; the Company will be able to raise any necessary additional capital on reasonable terms to execute its business plan; the Company’s current corporate activities will proceed as expected; general business and economic conditions will not change in a material adverse manner; and budgeted costs and expenditures are and will continue to be accurate.

Actual results and developments may differ materially from results and developments discussed in the forward-looking statements as they are subject to a number of significant risks and uncertainties, including: public health threats; fluctuations in metals prices, price of consumed commodities and currency markets; future profitability of mining operations; access to personnel; results of exploration and development activities, accuracy of technical information; risks related to ownership of properties; risks related to mining operations; risks related to mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently anticipated; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; changes in operating expenses; changes in general market and industry conditions; changes in legal or regulatory requirements; other risk factors set out in this presentation; and other risk factors set out in the Company’s public disclosure documents. Although the Company has attempted to identify significant risks and uncertainties that could cause actual results to differ materially, there may be other risks that cause results not to be as anticipated, estimated or intended. Certain of these risks and uncertainties are beyond the Company’s control. Consequently, all of the forward-looking statements are qualified by these cautionary statements, and there can be no assurances that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences or benefits to, or effect on, the Company.

The information contained in this presentation is derived from management of the Company and otherwise from publicly available information and does not purport to contain all of the information that an investor may desire to have in evaluating the Company. The information has not been independently verified, may prove to be imprecise, and is subject to material updating, revision and further amendment. While management is not aware of any misstatements regarding any industry data presented herein, no representation or warranty, express or implied, is made or given by or on behalf of the Company as to the accuracy, completeness or fairness of the information or opinions contained in this presentation and no responsibility or liability is accepted by any person for such information or opinions. The forward-looking statements and information in this presentation speak only as of the date of this presentation and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law. Although the Company believes that the expectations reflected in the forward-looking statements and information are reasonable, there can be no assurance that such expectations will prove to be correct. Because of the risks, uncertainties and assumptions contained herein, prospective investors should not read forward-looking information as guarantees of future performance or results and should not place undue reliance on forward-looking information. Nothing in this presentation is, or should be relied upon as, a promise or representation as to the future. To the extent any forward-looking statement in this presentation constitutes ‘future-oriented financial information’ or ‘financial outlooks’ within the meaning of applicable Canadian securities laws, such information is being provided to demonstrate the anticipated market penetration and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information and financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to the risks set out above. The Company’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, the Company’s revenue and expenses. The Company’s financial projections were not prepared with a view toward compliance with published guidelines of International Financial Reporting Standards and have not been examined, reviewed or compiled by the Company’s accountants or auditors. The Company’s financial projections represent management’s estimates as of the dates indicated thereon.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/8de562ce-2820-45c5-8612-27b9ec496811

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c5e486b-a52d-490c-ba47-66cff1ca79a2

https://www.globenewswire.com/NewsRoom/AttachmentNg/6574c00c-1175-4c7d-ab9a-51a12f6db274

https://www.globenewswire.com/NewsRoom/AttachmentNg/b7501fed-b45b-4caa-9664-4a5e3191b7d5

https://www.globenewswire.com/NewsRoom/AttachmentNg/982e982d-805c-4790-91f9-9df1cec52427

https://www.globenewswire.com/NewsRoom/AttachmentNg/16d091e6-fe3b-4948-a4a4-83158f225c31

https://www.globenewswire.com/NewsRoom/AttachmentNg/ead9ce30-67cd-4842-a938-e38ee2a022ea

https://www.globenewswire.com/NewsRoom/AttachmentNg/72c5171c-735e-47b9-a41e-07da3352448c

Brightstar Resources (BTR:AU) has announced High grade gold in early stage drilling at Sandstone

Brightstar Resources (BTR:AU) has announced High grade gold in early stage drilling at Sandstone